Table of Contents

In the bustling financial landscape of Chicago, effective accounting is not about crunching numbers, it's a strategic imperative for business to scale success. As one of the nation's premier financial hubs, Chicago offers a diverse array of accounting services tailored to meet the needs of its vibrant business community.

Whether you're a tech startup in 1871, a family-owned business in Lincoln Park, or a multinational corporation in the Loop, understanding the Chicago accounting landscape is crucial for your financial strategy. This comprehensive guide delves deep into the nuances of hiring an accounting firm in Chicago. We'll explore how the city's unique business ecosystem shapes accounting needs, examine the latest trends influencing financial services, and provide actionable insights to help you make an informed decision.

Different Industries and their Accounting Needs

Chicago's diverse economy encompasses a wide range of industries, each with its own unique accounting requirements. Understanding these industry-specific needs is crucial for businesses seeking the right accounting support.

Manufacturing and Industrial Sector

Chicago has a strong manufacturing base, from automotive parts to food processing. Businesses in this sector face unique accounting challenges that require specialized expertise and tailored solutions. The complexity of manufacturing operations demands a nuanced approach to financial management and reporting.

Key Accounting Challenges:

- Inventory Management: Accurate tracking of raw materials, work-in-progress, and finished goods is crucial.

- Cost Accounting: Precise allocation of direct and indirect costs is essential for pricing and profitability analysis.

- Equipment Depreciation: Proper accounting for machinery and equipment depreciation impacts financial statements and tax liabilities.

- Supply Chain Financial Management: Monitoring and optimizing the financial aspects of the supply chain is vital.

Specific accounting needs include:

- Advanced inventory valuation methods (FIFO, LIFO, weighted average)

- Activity-based costing systems

- Capital expenditure planning and analysis

- Compliance with industry-specific regulations (e.g., EPA for chemical manufacturers)

Manufacturing businesses in Chicago must also consider the impact of global trade policies and fluctuating commodity prices on their financial strategies. Accountants serving this sector should be well-versed in international accounting standards and able to provide insights on optimizing operations for financial efficiency.

Technology and Innovation

With hubs like 1871 and the Illinois Technology Association, Chicago's tech scene is currently booming. Tech companies have distinct accounting needs that evolve rapidly alongside technological advancements. The fast-paced nature of this industry requires agile financial management and forward-thinking accounting practices.

Key Accounting Challenges:

- Revenue Recognition: Dealing with complex revenue models, including subscriptions and long-term contracts.

- R&D Tax Credits: Maximizing tax benefits for research and development activities.

- Equity Compensation: Managing stock options and other forms of equity-based compensation.

- Rapid Scaling: Adapting financial systems to support fast growth.

Key accounting requirements include:

- Expertise in ASC 606 revenue recognition standards

- Valuation of intangible assets and intellectual property

- Cash flow forecasting for high-growth scenarios

- Familiarity with venture capital and other tech funding structures

Tech companies in Chicago must also navigate the complexities of digital taxation and data privacy regulations. Accountants in this sector should stay abreast of emerging technologies like blockchain and AI, understanding their potential impacts on financial processes and reporting.

Financial Services

As a major financial center, Chicago is home to numerous banks, insurance companies, and trading firms. This sector requires specialized accounting knowledge to navigate complex regulatory landscapes and manage sophisticated financial instruments. The interconnected nature of global finance adds another layer of complexity to accounting in this sector.

Key Accounting Challenges:

- Regulatory Compliance: Adhering to complex regulations like Dodd-Frank and Basel III.

- Risk Management: Accounting for various financial risks, including market, credit, and operational risks.

- Financial Instruments: Proper valuation and reporting of complex financial instruments.

- Fiduciary Accounting: Managing and reporting on funds held in trust.

Specific accounting needs include:

- Expertise in GAAP and IFRS standards specific to financial institutions

- Advanced financial modeling and stress testing capabilities

- Proficiency in regulatory reporting (e.g., call reports for banks)

- Knowledge of blockchain and cryptocurrency accounting

Financial services firms in Chicago must also consider the impact of fintech innovations on traditional accounting practices. Accountants in this sector should be prepared to adapt to new technologies and evolving regulatory frameworks, providing strategic advice on risk management and compliance.

Healthcare and Life Sciences

With world-class hospitals and research institutions, Chicago's healthcare sector has unique accounting requirements that reflect the complex nature of healthcare delivery and medical research. The intersection of patient care, scientific advancement, and business operations creates distinctive financial management challenges.

Key Accounting Challenges:

- Revenue Cycle Management: Dealing with complex billing and reimbursement systems.

- Compliance: Adhering to healthcare-specific regulations like HIPAA.

- Grant Accounting: Managing and reporting on research grants for institutions.

- Cost Containment: Analyzing and optimizing healthcare delivery costs.

Key accounting needs include:

- Expertise in healthcare reimbursement models (Medicare, Medicaid, private insurance)

- Proficiency in medical coding and billing systems

- Knowledge of healthcare-specific tax issues and exemptions

- Experience with clinical trial accounting for pharmaceutical companies

Healthcare organizations in Chicago must also navigate the financial implications of value-based care models and telemedicine. Accountants serving this sector should be able to provide insights on optimizing revenue cycles and managing the financial aspects of patient care quality initiatives.

Hospitality and Tourism

Chicago's vibrant hospitality sector, from iconic hotels to award-winning restaurants, requires specialized accounting services that can handle the unique aspects of the tourism industry. The seasonal nature of tourism and the multi-faceted operations of hospitality businesses create distinct financial management challenges.

Key Accounting Challenges:

- Seasonal Revenue Management: Dealing with fluctuations in demand and pricing.

- Multi-outlet Accounting: Managing finances for various revenue centers within a single establishment.

- Tips and Service Charge Accounting: Properly handling and reporting gratuities.

- Occupancy Tax Compliance: Navigating Chicago's complex hotel tax landscape.

Specific accounting needs include:

- Uniform System of Accounts for the Lodging Industry (USALI) expertise

- Food and beverage cost control systems

- Labor cost management and scheduling optimization

- Proficiency in hospitality-specific performance metrics (RevPAR, ADR, etc.)

Hospitality businesses in Chicago must also consider the financial implications of emerging trends like experiential tourism and short-term rentals. Accountants in this sector should be able to provide strategic advice on pricing strategies and cost management in a highly competitive market.

Real Estate and Construction

Chicago's dynamic real estate market and ongoing construction projects demand specialized accounting knowledge that can handle the complexities of long-term projects and property management. The cyclical nature of real estate and the project-based structure of construction create unique financial reporting and management challenges.

Key Accounting Challenges:

- Project Accounting: Tracking costs and revenues for long-term construction projects.

- Lease Accounting: Implementing new standards like ASC 842 for lessees and lessors.

- Property Tax Management: Navigating Chicago's complex property tax system.

- Cost Segregation Studies: Maximizing tax benefits for real estate investors.

Key accounting requirements include:

- Expertise in percentage-of-completion accounting methods

- Proficiency in construction billing methods (AIA, cost-plus, etc.)

- Knowledge of 1031 exchange and other real estate tax strategies

- Familiarity with construction lien laws and compliance

By understanding the specific accounting needs of these diverse industries, businesses in Chicago can better identify the type of accounting expertise they require. Whether you're in manufacturing, tech, finance, healthcare, hospitality, or real estate, partnering with an accounting firm that understands your industry's unique challenges can provide significant value to your business. The right accounting partner will not only ensure compliance and accurate reporting but also offer strategic insights to drive growth and profitability in your specific sector.

How to Determine Accounting Needs for Your Business

When assessing your company's accounting requirements, consider these key factors to ensure you partner with the right firm in Chicago:

Business Size and Complexity- The scale and intricacy of your operations significantly influence your accounting needs. Small businesses may require only basic bookkeeping and tax preparation services. As your company grows, you'll likely need more comprehensive financial management, including detailed financial analysis, forecasting, and strategic planning. Large enterprises often require full-service accounting support, encompassing audit assistance, complex financial reporting, and specialized advisory services.

Industry-Specific Requirements- Your industry plays a crucial role in determining your accounting needs. As outlined earlier in this guide, different sectors have unique financial management challenges. For instance, manufacturing companies need expertise in inventory valuation and cost accounting, while tech startups might require proficiency in handling equity compensation and R&D tax credits. Review the specific accounting challenges in your industry and seek a firm with relevant expertise.

Growth Stage and Future Plans- Your company's current growth stage and future aspirations should shape your accounting strategy. Startups often need help with initial financial setup, funding strategies, and implementing scalable systems. Established businesses might focus more on optimizing operations and strategic financial planning. If you're considering expansion, mergers, or acquisitions, you'll need specialized advisory services to navigate these complex transactions.

Compliance and Regulatory Landscape- Understanding and adhering to relevant regulations is critical for every business. Consider local, state, and federal tax obligations specific to your operations in Chicago. Additionally, factor in industry-specific compliance requirements, such as HIPAA for healthcare or Dodd-Frank for financial services. Your chosen accounting firm should have a strong grasp of these regulations to ensure your business remains compliant.

Reporting and Decision-Making Needs- Effective financial reporting is crucial for informed decision-making. Assess what types of financial reports are most valuable for your business strategy. Do you need real-time financial data, or are periodic reports sufficient? Consider whether you require assistance with cash flow forecasting, budgeting, or performance metrics specific to your industry. Your accounting partner should be able to provide the insights you need to drive your business forward.

Technology Integration and Automation- Evaluate your current systems and determine if you need support integrating accounting software with other business applications. Consider whether you require assistance implementing or managing cloud-based accounting solutions. The right accounting firm should be able to recommend and support technology that improves your financial processes and provides better visibility into your business performance.

Budget and Resource Allocation- Consider your budget for accounting services and how it aligns with your overall financial strategy. Evaluate the cost-benefit of outsourcing versus hiring in-house staff. Remember that while quality accounting services are an investment, they can provide significant returns through improved financial management, tax savings, and strategic insights. Look for a firm that offers a service model that fits your budget while meeting your current needs and being able to scale as your business grows.

How to choose between Fixed Accountants vs. Outsourced Accounting Services

|

Aspect |

Fixed Accountants |

Outsourced Accounting Services |

|

Advantages |

• Deep understanding of company culture and processes• Immediate availability and responsiveness • Direct control over work and priorities • Consistent point of contact for other departments • Ability to tailor skills to company-specific needs over time • Greater confidentiality and data security (in-house) • Easier integration with other internal teams |

• Access to diverse expertise and specialized skills • Scalable services to match business growth or contraction • Potentially lower costs (no benefits, office space, etc.) • Access to latest accounting technology and practices • Objective third-party perspective on financials • Continuous service (not affected by employee leave) • Flexibility in service levels and contract terms |

|

Disadvantages |

• Higher fixed costs (salary, benefits, training) • Limited expertise in specialized areas• Potential for skill stagnation if not regularly updated • Vulnerability to staff turnover and associated knowledge loss • May struggle with workload fluctuations • Ongoing training and professional development costs • Idle time during slower periods |

• Less direct control over day-to-day activities • Potential communication challenges or delays • Possible data security and confidentiality concerns • May lack deep, long-term company-specific knowledge • Potential for less personalized service • Dependency on external provider • Possible cultural misalignment |

|

Best suited for |

• Large companies with complex, ongoing accounting needs • Businesses with highly sensitive financial information • Companies with stable, predictable accounting workloads • Organizations requiring constant financial oversight • Businesses with unique or specialized accounting processes • Companies valuing deep institutional knowledge • Firms in highly regulated industries needing close compliance monitoring |

• Small to medium-sized businesses • Companies with fluctuating or seasonal accounting needs • Businesses requiring specialized expertise in multiple areas• Startups and rapidly growing companies • Organizations looking to reduce overhead costs • Companies undergoing financial transformations or system changes • Businesses wanting to focus on core competencies |

|

Cost considerations |

• Predictable monthly costs• Higher long-term investment (salary increases, benefits) • Additional costs for specialized software and training |

• Variable costs based on services used • Potential for cost savings in the long run • No additional costs for technology or training |

|

Flexibility |

• Limited by individual or team capacity • May require hiring additional staff for new needs • Can be cross-trained for other finance roles |

• Highly flexible, can scale services up or down • Easy to add specialized services as needed • Can provide temporary or project-based support |

|

Technology & Innovation |

• May lag in adopting new technologies • Limited exposure to diverse accounting practices • Require ongoing investment in training and tools |

• Often use cutting-edge accounting software • Bring best practices from diverse client experiences • Continuously updated on industry trends and regulations |

How to Choose the Right Accounting Software

The right software can streamline operations, improve accuracy, and provide valuable insights for decision-making. The accounting software market offers a wide range of options, from simple bookkeeping tools to comprehensive enterprise resource planning (ERP) systems. Some popular choices include:

- QuickBooks: Widely used by small to medium-sized businesses, offering both cloud and desktop versions.

- Xero: Cloud-based solution known for its user-friendly interface and robust features.

- Sage: Offers scalable solutions suitable for businesses of various sizes and industries.

- NetSuite: Comprehensive cloud-based ERP system with strong accounting capabilities.

- FreshBooks: Ideal for service-based businesses and freelancers.

- Wave: Free option for very small businesses or startups with basic needs.

When evaluating these options, consider factors such as ease of use, scalability, industry-specific features, and integration capabilities.

Cloud-based vs. On-premise Solutions- One of the first decisions you'll need to make is whether to opt for a cloud-based or on-premise solution.

Cloud-based Solutions:

- Accessible from anywhere with an internet connection

- Regular updates and backups managed by the provider

- Lower upfront costs and predictable monthly expenses

- Easier collaboration with team members and accountants

- Potential concerns about data security and internet dependency

On-premise Solutions:

- Data stored locally, providing more control over security

- One-time purchase with periodic upgrade costs

- Not dependent on internet connectivity

- May require more IT support and maintenance

- Limited remote access capabilities

For many Chicago businesses, especially those embracing remote work or requiring real-time financial data across multiple locations, cloud-based solutions often prove advantageous. However, industries with stringent data security requirements may prefer on-premise options.

Integration with Other Business Systems- Modern businesses rely on various software systems for different functions. Your accounting software should integrate seamlessly with other key business systems, such as:

- Customer Relationship Management (CRM) systems

- E-commerce platforms

- Point of Sale (POS) systems

- Payroll and HR management tools

- Inventory management software

- Project management tools

Look for accounting software that offers robust API capabilities or pre-built integrations with the systems your business already uses. This integration can significantly reduce manual data entry, minimize errors, and provide a more comprehensive view of your business operations.

Training and Implementation- The success of your accounting software implementation largely depends on proper training and setup. Consider the following:

- Vendor-provided training: Many software providers offer training resources, from online tutorials to in-person workshops. Assess the quality and accessibility of these resources.

- Implementation support: Determine what level of support the vendor provides during the setup process. This is particularly important for complex systems or when migrating from another software.

- User adoption: Consider the learning curve for your team. Software with an intuitive interface and similarities to your current processes can ease the transition.

- Customization options: Evaluate how well the software can be tailored to your specific business processes and reporting needs.

- Ongoing support: Look into the availability and quality of customer support, including response times and support channels (phone, email, chat).

When choosing accounting software, it's essential to involve key stakeholders in the decision-making process. This might include your internal accounting team, IT department, and even your external CPA or accounting firm. Their insights can help ensure that the chosen solution meets both your current needs and future growth plans.

How Much Do Accounting Firms in Chicago Charge?

Understanding the cost of accounting services is crucial for businesses budgeting for financial management. In Chicago, accounting firm fees can vary widely based on factors such as the firm's size, expertise, and the complexity of services required. Here's an overview of common fee structures and considerations:

Fee Structures

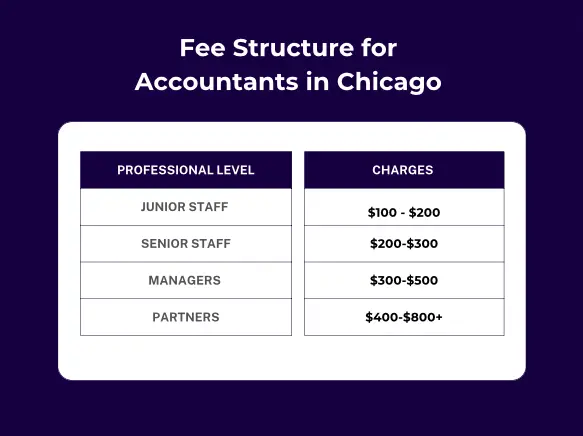

Hourly Rates: Hourly billing is common for project-based work or when the scope of services is unclear. Rates in Chicago typically range as follows:

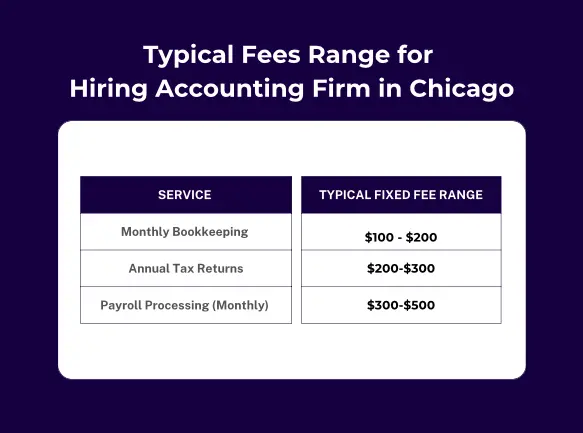

Fixed Fees: Many firms offer fixed fee arrangements for routine services like tax preparation or monthly bookkeeping. This provides cost certainty for businesses. Example fixed fee ranges:

Value-Based Pricing: Some firms are moving towards value-based pricing, where fees are based on the perceived value of the service to the client rather than time spent. This might be used for advisory services or complex projects where the firm's expertise can significantly impact the client's bottom line.

Additional Costs to Consider

- Software fees: If the firm uses specific accounting software, there may be additional licensing costs.

- Out-of-pocket expenses: Travel, printing, or other direct costs may be billed separately.

- Rush fees: Expedited services often incur premium charges.

- Specialist consultations: Complex issues requiring niche expertise may result in additional fees.

ROI of Hiring an Accounting Firm

While accounting services represent a significant investment, the return on investment (ROI) can be substantial:

- Tax savings: Expert tax planning can often save more than the cost of services.

- Time savings: Outsourcing allows business owners to focus on core operations.

- Reduced errors: Professional oversight minimizes costly mistakes.

- Strategic insights: High-level financial analysis can drive better business decisions.

- Scalability: As your business grows, a good accounting firm can provide increasingly sophisticated services.

When evaluating costs, consider the long-term value and potential savings that come with professional financial management. A skilled accounting firm in Chicago can be a valuable partner in your business's financial success, often providing returns that far exceed their fees.

What are the Services Offered by Accounting Firms in Chicago?

Accounting firms in Chicago offer a wide range of services to meet the diverse needs of businesses across various industries. Understanding these services can help you choose the right firm for your specific requirements. Here's an overview of the key services typically offered:

Bookkeeping- Bookkeeping forms the foundation of sound financial management. Chicago accounting firms offer bookkeeping services that include daily, weekly, or monthly transaction recording, bank and credit card reconciliations, accounts payable and receivable management, and preparation of financial statements such as balance sheets, income statements, and cash flow statements. Payroll processing and reporting are also essential components of bookkeeping services provided by these firms.

Tax Preparation and Planning- Tax services are a core offering of most accounting firms. This encompasses preparation of federal, state, and local tax returns for both businesses and individuals. Additionally, these firms provide strategic tax planning to help minimize tax liabilities and represent clients before tax authorities in case of audits. Assistance with tax credits and incentives specific to Chicago and Illinois is another valuable service offered by accounting firms in the city.

Auditing- Auditing services provide assurance on the accuracy and compliance of financial statements. These services include financial statement audits, internal audits to assess operational efficiency and risk management, and compliance audits for regulatory requirements. Specialized audits, such as those for government grants or industry-specific regulations, are also offered by many accounting firms in Chicago.

Financial Reporting- Accurate and timely financial reporting is crucial for decision-making. Firms offer preparation of GAAP-compliant financial statements, management reporting and KPI dashboards, financial forecasting and budgeting, and assistance with reporting for investors or lenders.

Business Advisory Services- Many Chicago accounting firms go beyond traditional services to offer strategic advice. This includes financial analysis and performance improvement recommendations, cash flow management and working capital optimization, business valuation services, succession planning, and technology consulting for financial systems.

Accounts Payable (AP) and Accounts Receivable (AR) Services- Efficient management of accounts payable and receivable is crucial for maintaining cash flow. Chicago accounting firms offer services such as invoice processing, vendor management, payment processing, and dispute resolution for accounts payable. On the accounts receivable side, they provide services like customer invoicing, collections, and aging analysis.

Conclusion

Navigating Chicago's complex financial landscape requires more than just number-crunching—it demands a strategic partnership with an accounting firm that understands your industry and aligns with your business goals. NSKT Global offers tailored accounting solutions for Chicago's diverse business sectors, from manufacturing to tech startups, healthcare to hospitality. With expertise in bookkeeping, tax services, auditing, financial reporting, and business advisory, NSKT Global is equipped to meet your unique financial management needs. Whether you're seeking tax savings, improved cash flow, or strategic insights for better decision-making, NSKT Global can be your trusted partner.

Ready to elevate your business's financial strategy? Contact NSKT Global today for a consultation and gain the strategic advantage your Chicago business deserves.