What Is the QSBS Tax Exemption in California?

The Qualified Small Business Stock (QSBS) tax exemption is a golden ticket for investors looking to reap significant tax savings when backing small businesses. While the federal government rewards long-term investments in startups, California plays by its own rules, ones that have changed dramatically over the years. If you're investing in the Golden State, understanding these shifts is crucial to maximizing your gains and minimizing your tax liabilities.

Overview of the Federal QSBS Tax Exemption

The QSBS tax exemption, governed by Section 1202 of the Internal Revenue Code, allows eligible investors to exclude up to 100% of capital gains on the sale of qualified small business stock. To qualify, the investment must meet the following criteria:

- The stock must be issued by a domestic C corporation.

- The investor must hold the stock for a minimum of five years.

- The issuing corporation’s total assets must not exceed $50 million at the time of stock issuance.

The amount of the exclusion is capped at the greater of $10 million or 10 times the investor’s basis in the stock. This provision aims to stimulate investment in small businesses by reducing the tax burden on successful investments. However, while this exemption is beneficial at the federal level, state tax treatment can vary significantly.

California's Historical Stance on QSBS Tax Exemptions

Historically, California conformed partially to federal QSBS guidelines, allowing for a partial state-level tax exclusion on qualifying investments. This exclusion was outlined under California Revenue and Taxation Code Sections 18152.5 and 18038.5, which required that at least 80% of the company’s payroll and assets be based in California to qualify for the state tax break.

Key aspects of California’s historical QSBS tax exemption:

- Encouraged local investments by requiring companies to have significant operations within the state.

- Provided tax relief to investors, making California-based startups more attractive for funding.

- Helped early-stage businesses secure financing by reducing investor tax liabilities.

- Supported the growth of industries like technology, biotech, and manufacturing by driving local venture capital interest.

- Increased job creation within California by incentivizing investment in in-state businesses.

Repeal of California's QSBS Exemptions in 2013

In 2012, a California Court of Appeal ruling found that the state’s QSBS tax provisions violated the Commerce Clause of the U.S. Constitution by favoring in-state businesses over out-of-state companies. This decision led to a major shift in tax policy, and in 2013, California fully repealed its QSBS tax exemption. Here’s what changed:

- QSBS capital gains are fully taxable: Before the repeal, investors enjoyed state-level tax breaks on qualifying QSBS gains. Now, all such gains are subject to California’s standard tax rates, which can reach up to 13.3%.

- Retroactive tax implications: The repeal was not only applied moving forward but also retroactively. This meant that investors who had previously claimed the exemption suddenly found themselves facing unexpected tax liabilities.

- California lost its investor-friendly edge: With no QSBS tax benefits at the state level, California became a less attractive option for startup investments compared to states that still offer such exemptions, such as Texas and Florida.

- Broader impact on the startup ecosystem: The repeal discouraged some investors from backing early-stage California companies, shifting capital toward states with more favorable tax environments.

The removal of the QSBS tax break created challenges for both investors and entrepreneurs, reducing the incentives for local startup funding and making tax planning even more crucial for those looking to invest in small businesses within the state.

Current Tax Implications for California Investors in 2025

As of 2025, California continues to diverge from federal QSBS tax policies, meaning that investors in the state do not benefit from the federal exclusion when selling QSBS. Here’s what that means for investors:

- QSBS gains are fully taxable in California: Unlike federal law, which allows up to a 100% exclusion on eligible QSBS gains, California considers these gains as ordinary taxable income, subject to the state’s high capital gains tax rates.

- High tax rates impact investment decisions: Investors face California's capital gains tax rates, which can reach up to 13.3%, significantly reducing net profits from QSBS sales.

- No state-level incentives for startup investors: Unlike other states that offer QSBS tax breaks, California provides no additional tax relief for investors, making it less competitive in attracting startup capital.

- Potential for double taxation: Investors who reside in California but hold QSBS in out-of-state companies may still be subject to full state taxation on their gains, increasing their overall tax liability.

- Limited workaround options: Since California does not conform to federal QSBS laws, investors need to explore strategic planning, such as relocating or using charitable contributions, to mitigate their tax burden.

Strategies for Managing QSBS Gains in California

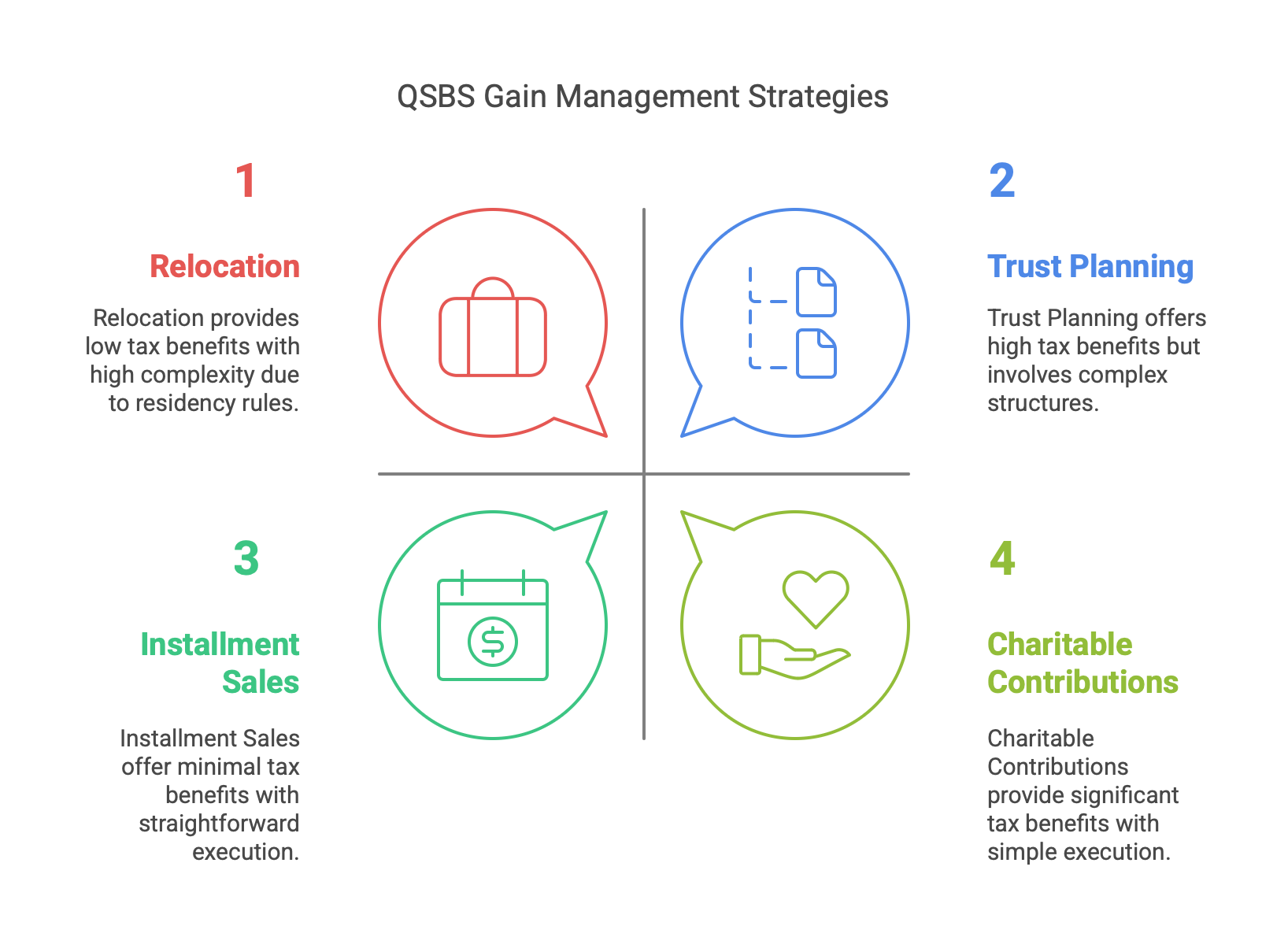

Given California’s unfavorable tax treatment of QSBS, investors should explore strategic tax planning to minimize liabilities and optimize gains. Here are some of the most effective strategies:

- Relocation: Moving to a state with no income tax—such as Texas or Florida—before selling QSBS can eliminate California state taxes on the gains. However, investors must meet stringent residency requirements, ensuring they do not trigger California’s aggressive tax enforcement rules.

- Charitable Contributions: Donating QSBS to a qualified charitable organization can offer significant tax benefits. By donating before selling, investors can claim a federal charitable deduction for the fair market value of the stock while also avoiding capital gains taxes on the appreciation.

- Installment Sales: Instead of selling QSBS in a single transaction, structuring the sale as an installment sale allows investors to spread out taxable income over multiple years. This strategy can help keep investors in lower tax brackets, reducing their overall tax liability.

- Opportunity Zones: Investors can defer and potentially reduce federal taxes by reinvesting QSBS gains into Qualified Opportunity Funds (QOFs). While California does not conform to this tax incentive, it remains a viable strategy for federal tax savings and long-term capital appreciation.

- Trust Planning: Establishing trusts, such as a Non-Grantor Trust in a tax-friendly state, can allow investors to minimize state tax exposure. Properly structured trusts can provide long-term tax benefits while maintaining flexibility for wealth management and legacy planning.

Locations We Serve In California

Potential Future Changes to California's QSBS Policies

Currently, there are no indications that California will reinstate its QSBS tax exemptions. However, given the state's reliance on the startup ecosystem, legislative changes could emerge in response to investor concerns. Taxpayers should stay informed about any proposed legislation that may impact QSBS taxation in the future.

Potential developments to watch for include:

- Legislative proposals: California lawmakers could introduce bills to reinstate partial or full QSBS exemptions to attract more investments in startups.

- Investor advocacy efforts: Pressure from venture capitalists, angel investors, and business leaders may push for policy changes.

- Economic shifts: A downturn in California’s startup ecosystem could encourage policymakers to reconsider tax incentives to maintain competitiveness.

- Comparative state policies: As other states continue to offer QSBS tax breaks, California may face increasing pressure to align with investor-friendly jurisdictions.

- Judicial challenges: Future court cases could revisit the legality of QSBS taxation policies and influence potential revisions.

While no immediate changes are expected, keeping an eye on these factors can help investors stay ahead of potential tax law adjustments.

Conclusion

While the federal QSBS tax exemption remains a powerful tool for investors, California’s tax policies have thrown a wrench into the equation, making it a challenging landscape for those residing in the state. Since 2013, the full taxation of QSBS gains has significantly increased the financial burden on investors, forcing them to rethink their strategies. With high tax rates and no state-level relief, smart tax planning is not just an option—it’s a necessity.

The key to navigating these complexities is staying informed and working with experienced tax professionals. NSKT Global specializes in helping investors develop tax-efficient strategies, ensuring compliance while maximizing financial benefits. Whether it’s relocation planning, structuring installment sales, or leveraging charitable contributions, their expert team can guide you toward the best course of action tailored to your unique investment goals.

FAQs About the QSBS Tax Exemption in California

Does California offer a state-level QSBS tax exemption as of 2025?

No, California fully taxes QSBS gains and does not provide any state-level exemption.

How does the repeal of California's QSBS exemptions affect investors?

Investors in California must now pay full state capital gains taxes on QSBS sales, increasing their overall tax burden.

Can California residents still benefit from federal QSBS tax exemptions?

Yes, California residents can claim the federal QSBS exemption, but they must still pay state taxes on their gains.

What strategies can California investors use to manage QSBS gains?

Investors can consider relocation, charitable contributions, installment sales, Opportunity Zones, and trust planning to minimize tax liabilities.

Are there any anticipated changes to California's QSBS tax policies in the near future?

There are no current indications of policy changes, but legislative proposals and economic factors could influence future tax treatment.