Importance of availing virtual CFO services for your business In UAE?

A virtual CFO which stands for Virtual chief financial officer is a highly skilled outsourced service provider who offers assistance in financial matters of an organization. A virtual CFO can be a single person or an entity who does the same work which is done by a chief financial officer for a large enterprise. Many startups and corporates are looking for services that can be outsourced to minimize the number of staff when possible. This led to an increase in the number of appointments for a virtual CFO rather than hiring an in-house full-time CFO.

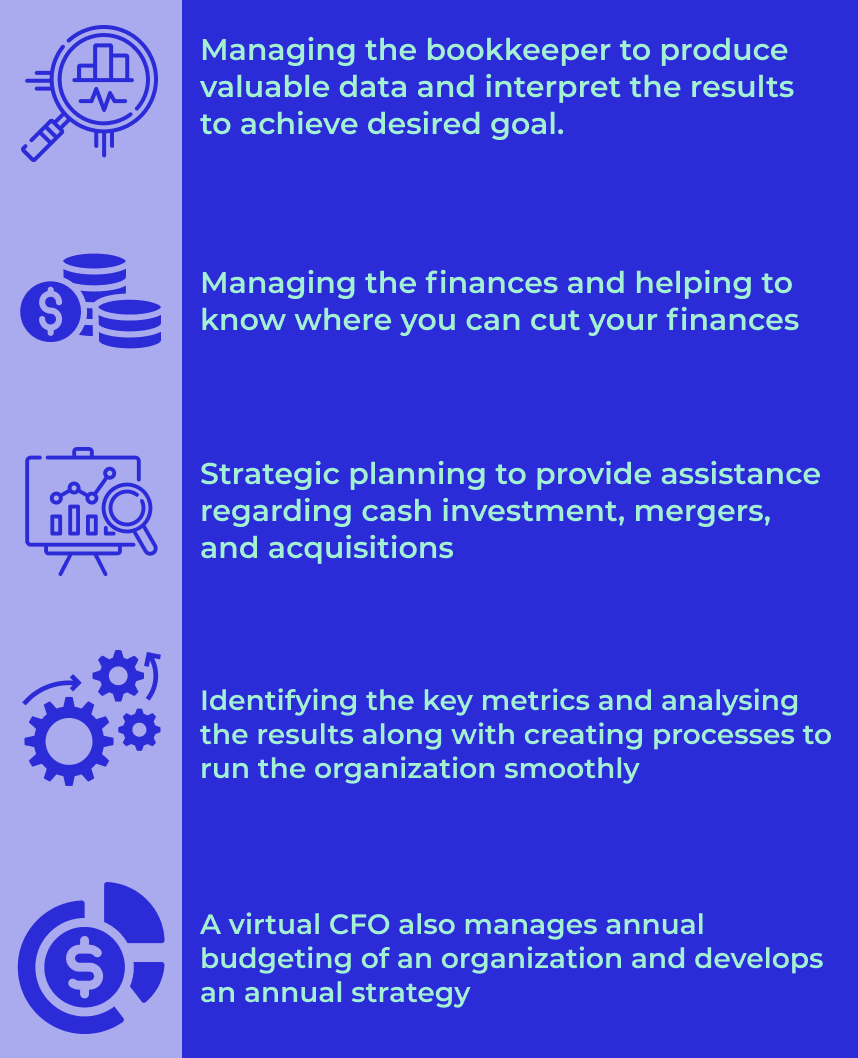

Services offered by a virtual CFO include:

- A CFO helps in managing the bookkeeper to produce valuable data and interpret the results so that your desired goal can be achieved. This helps you in analyzing the process and helps you plan your next step.

- A CFO guides you in managing the finances and helps to know where you can cut off your finances and where deploying cash can work efficiently. Also helps you in analyzing the opportunities for expansion and makes you stand ahead of your competitors.

- Strategic planning is always a work of a CFO but nowadays virtual CFOs have started giving strategic planning to organizations. They provide assistance regarding cash investment, mergers, and acquisitions.

- A virtual CFO helps you in identifying the key metrics and analyze the results along with creating a process to run the organization smoothly in terms of finances. They also interpret the financial position of a company regularly and give suggestions.

- A virtual CFO also manages the annual budgeting of an organization and develops an annual strategy so that the organization can smoothly run towards achieving the goal for the year and also attain the long-term vision of the company.

- A virtual CFO also maintains cordial relations with employees and works as a mediator between the stakeholders and the board of directors to solve any kind of issue that arises in the finance of the organization.

A virtual CFO in an SME helps in managing the gap between operations, finances, and strategies to help achieve the long-term goals which helps the owners in creating a strong decision-making process. Apart from this a virtual CFO also helps SMEs in several ways such as:

- Help assure better management by better planning for the financial year by managing the balance sheets by mentioning all the assets and liabilities of the company.

- As an SME suffers from deficit management which is a sign of weak internal control. So, it is very important for them to have a regular check on internal controls which is done by a virtual CFO.

- A virtual CFO helps to ensure that the financial and accounting team provides the correct figure for the profits to analyze the performance of the organization.

- A virtual CFO helps in improving both top and bottom line revenue figures. They also offer SMEs opportunities to open up new markets and enhance the market growth.

The role of a virtual CFO has been trending these days because many businesses are preferring to reduce the number of staff in their organization. A virtual CFO needs to have knowledge and capabilities to attain success. NSKT Global provides the best in class virtual CFO services in Dubai & Abu-Dhabi which are trained with international standards and can help you and your business grow.