Table of Contents

In today's interconnected global economy, it's increasingly common for individuals to hold assets in foreign countries. While this can offer numerous financial advantages, it also comes with specific reporting requirements for U.S. taxpayers. Two crucial forms that US citizens living abroad must know about are the Foreign Bank Account Report (FBAR) and Form 8938. Understanding the differences between these forms is essential for maintaining compliance with U.S. tax laws and avoiding potentially severe penalties. We have covered the key aspects of both FBAR and Form 8938, highlighting their differences and providing valuable insights to help you navigate these complex reporting requirements. Whether you're an expatriate, a green card holder, or a U.S. resident with foreign investments, this information will be crucial for your financial compliance.

What is FBAR (FinCEN Form 114)?

The Foreign Bank Account Report, commonly known as FBAR, is a critical tool used by the U.S. government to combat tax evasion and money laundering. Introduced in 1970 as part of the Bank Secrecy Act, FBAR requires U.S. persons to report their foreign financial accounts if the aggregate value exceeds certain thresholds. The primary goal is to create transparency in foreign holdings and discourage the use of offshore accounts for illicit purposes.

Who should file FBAR?

The requirement to file an FBAR includes U.S. citizens, resident aliens, and entities (including corporations, partnerships, and trusts) if they have a financial interest in or signature authority over foreign financial accounts. This requirement applies regardless of whether the account produces taxable income. It's important to note that even if you have no financial interest in an account but merely have signature authority, you may still be required to file an FBAR.

What are the Filing Thresholds for Fbar?

The filing threshold for FBAR is straightforward and applies universally. If the total value of all foreign financial accounts exceeds $10,000 at any time during the calendar year, you must file an FBAR. This threshold applies regardless of whether you're filing as an individual or entity. It's crucial to understand that this is an aggregate threshold – meaning if you have multiple foreign accounts whose combined value exceeds $10,000 at any point in the year, you must report all of these accounts, even if no single account exceeds $10,000.

What are the types of accounts covered in FBAR?

FBAR covers a wide range of foreign financial accounts, including:

- Traditional bank accounts, such as checking and savings accounts.

- Securities accounts, including brokerage accounts and securities derivatives.

- Other financial accounts such as life insurance policies with cash value fall under the FBAR requirements

- Mutual funds or similar pooled funds

- Other accounts maintained with a foreign financial institution.

It's important to note that the term "foreign" refers to the location of the financial institution, not the currency of the account. For example, a U.S. dollar account at a bank in France would be considered a foreign account for FBAR purposes.

What is the Filing Deadline for FBAR?

The FBAR must be filed electronically through the Financial Crimes Enforcement Network's (FinCEN) BSA E-Filing System. This online filing requirement has been in place since 2013, streamlining the process and improving data accuracy. The deadline for filing is April 15th, aligning with the traditional tax filing date. However, there's an automatic extension to October 15th if you miss the April deadline, and you don't need to request this extension formally. It's crucial to understand that FBAR is filed separately from your tax return. This separate filing is a common point of confusion for many taxpayers, who mistakenly believe that reporting foreign accounts on their tax returns is sufficient.

What is Form 8938?

Form 8938, officially titled "Statement of Specified Foreign Financial Assets," was introduced as part of the Foreign Account Tax Compliance Act (FATCA) in 2010. Its purpose is to provide the Internal Revenue Service (IRS) with comprehensive information about foreign financial assets held by U.S. taxpayers. While it may seem similar to FBAR at first glance, Form 8938 serves a distinct purpose and has different reporting requirements. The introduction of Form 8938 represents an expansion of the U.S. government's efforts to combat offshore tax evasion and ensure that U.S. taxpayers are properly reporting their worldwide income.

Who Should file Form 8938?

The requirement to file Form 8938 applies to a broad range of individuals. U.S. citizens, resident aliens, and certain non-resident aliens who have an interest in specified foreign financial assets must file Form 8938 if the total value of those assets exceeds the applicable reporting threshold. This includes not only those living in the United States but also U.S. citizens and resident aliens living abroad. It's important to note that unlike FBAR, which is filed by individuals and entities, Form 8938 is generally filed only by individuals. However, certain domestic entities may also be required to file Form 8938 in some circumstances.

What are the Filing Thresholds for form 8938?

The filing thresholds for Form 8938 are more complex than those for FBAR and vary based on your filing status and whether you live in the U.S. or abroad. For U.S. residents who are unmarried or married filing separately, the threshold is met if the total value of specified foreign financial assets exceeds $50,000 on the last day of the tax year or $75,000 at any time during the year. For married couples filing jointly, these thresholds double to $100,000 on the last day of the tax year or $150,000 at any time during the year.

The thresholds are higher for U.S. taxpayers living abroad. Unmarried taxpayers or those married filing separately must file if the total value of their specified foreign financial assets exceeds $200,000 on the last day of the tax year or $300,000 at any time during the year. For married couples filing jointly, these thresholds increase to $400,000 on the last day of the tax year or $600,000 at any time during the year. These varying thresholds reflect the recognition that U.S. persons living abroad are more likely to have foreign financial assets for legitimate reasons related to their residence outside the United States. The thresholds are higher for U.S. taxpayers living abroad. Unmarried taxpayers or those married filing separately must file if the total value of their specified foreign financial assets exceeds $200,000 on the last day of the tax year or $300,000 at any time during the year. For married couples filing jointly, these thresholds increase to $400,000 on the last day of the tax year or $600,000 at any time during the year. These varying thresholds reflect the recognition that U.S. persons living abroad are more likely to have foreign financial assets for legitimate reasons related to their residence outside the United States. You are considered a taxpayer living abroad if:

- You are a U.S. citizen whose tax home is in a foreign country and you are either a bona fide resident of a foreign country or countries for an uninterrupted period that includes the entire tax year, or

- You are a U.S. citizen or resident who, during a period of 12 consecutive months ending in the tax year, is physically present in a foreign country or countries for at least 330 days.

What are the types of assets covered in form 8938?

Form 8938 covers a broader range of foreign financial assets than FBAR, including:

- Foreign bank accounts: Checking, savings, and other deposit accounts held with foreign financial institutions.

- Foreign securities accounts: Brokerage accounts holding stocks, bonds, and other securities issued by non-U.S.entities.

- Ownership interests in foreign entities: Shares in foreign corporations, partnerships, or other legal structures.

- Foreign financial contracts: Derivatives, options, and other financial instruments with non-U.S. counterparties.

- Financial accounts held with foreign financial institutions: This includes a broad range of accounts beyond just bank accounts, such as investment accounts and custodial accounts.

Filing as Part of Tax Return

Unlike FBAR, which is filed separately, Form 8938 is filed with your annual federal income tax return (Form 1040). This integration with the tax return underscores the IRS's focus on ensuring that income from foreign assets is properly reported and taxed. It also means that the deadline for filing Form 8938 aligns with your tax return due date, including extensions if applicable.

What are Key Differences Between FBAR and Form 8928?

|

Aspect |

FBAR (FinCEN Form 114) |

Form 8938 |

|

Purpose |

Report foreign financial accounts |

Report specified foreign financial assets |

|

Filing Threshold |

$10,000 aggregate value at any time during the year |

Varies: $50,000 to $400,000 depending on filing status and residence |

|

Who Must File |

U.S. persons required to report include:

These U.S. persons must file if they:

|

Individuals and domestic entities who must report:

These specified individuals and domestic entities are required to report if they:

|

|

When do you have an interest in an account or asset? |

If your income tax return must include or reflect any income, gains, losses, deductions, credits, gross proceeds, or distributions resulting from holding or disposing of the account or asset. |

Financial interest: You are listed as the owner or hold legal title; someone acting as your agent or representative is the listed owner or legal title holder; you possess a substantial interest in the entity that is the listed owner or legal title holder. Signature authority: you can manage the assets in the account by directly interacting with the financial institution that maintains it. |

|

Filing Method |

Electronically through FinCEN BSA E-Filing System |

With annual federal tax return (Form 1040) |

|

Deadline |

April 15 (automatic extension to October 15) |

Tax return due date, including extensions |

|

Administering Agency |

Financial Crimes Enforcement Network (FinCEN) |

Internal Revenue Service (IRS) |

|

Penalties for Non-Filing |

Up to $10,000 per violation (non-willful); greater of $100,000 or 50% of account balances (willful) |

$10,000 for failure to file, up to $50,000 for continued failure after IRS notification |

|

Statute of Limitations |

6 years |

3 years (6 years if income omitted exceeds $5,000) |

|

Duplicate Reporting |

May need to report same account on both forms |

May need to report same asset on both forms |

|

Value Reporting |

Highest value during the year |

Highest value during the year and year-end value |

|

Tax Return Implications |

Separate from tax return |

Part of tax return, affects tax calculations |

How to Determine which Assets to Disclose for FBAR vs Form 8938?

|

Asset Type |

FBAR |

Form 8938 |

|

Foreign bank accounts |

Yes |

Yes |

|

Foreign securities accounts |

Yes |

Yes |

|

Foreign mutual funds |

Yes |

Yes |

|

Foreign-issued life insurance with cash value |

Yes |

Yes |

|

Foreign pension accounts |

Yes |

Yes |

|

Foreign financial accounts where you have signature authority only |

Yes |

No |

|

Foreign stock or securities held in a financial account at a foreign financial institution |

No |

Yes |

|

Foreign partnership interests |

No |

Yes |

|

Foreign hedge funds and private equity funds |

No |

Yes |

|

Foreign-issued annuity contracts |

Yes |

Yes |

|

Foreign digital assets (if specified foreign financial assets) |

No |

Yes |

|

Directly owned foreign real estate |

No |

No |

|

Foreign currency not held in a financial account |

No |

No |

|

Directly held precious metals |

No |

No |

|

Personal property (art, jewelry, cars) held for personal use |

No |

No |

|

Foreign assets held in U.S. accounts |

No |

Yes |

What are Special Filing Considerations for FBAR vs Form 8938?

Here are some distinctions to underscore the importance of understanding the specific requirements of each form and how they apply to your particular situation:

How to Report for Married Couples

Married couples have some unique considerations when it comes to FBAR and Form 8938 reporting. For FBAR, married couples have the option to file a joint FBAR if all reportable accounts are jointly owned. However, if either spouse has separate accounts, they must file separate FBARs. For Form 8938, even if a couple files a joint tax return, each spouse must file a separate Form 8938 if they meet the filing threshold. However, the threshold for married couples filing jointly is higher than for individuals or married couples filing separately.

How to Report for Expats

U.S. citizens living abroad face unique challenges in FBAR and Form 8938 reporting. While living in a foreign country often necessitates having foreign financial accounts, expats are still required to report these accounts if they meet the thresholds. For FBAR, the requirements are the same regardless of where you live. However, Form 8938 has higher reporting thresholds for U.S. taxpayers living abroad, recognizing the increased likelihood of having foreign financial assets. Expats should also be aware of potential tax treaties between the U.S. and their country of residence, which may affect their overall Expat taxation.

How to Report for Green Card Holders

Permanent residents (green card holders) are considered U.S. persons for tax purposes and are subject to the same FBAR and Form 8938 reporting requirements as U.S. citizens. This applies even if the green card holder is living outside the United States. Green card holders should be particularly careful about reporting foreign accounts and assets they held before obtaining their green card, as these still need to be reported once they become U.S. residents for tax purposes.

How to report for non-resident alien

Non-resident aliens have different reporting requirements for FBAR and Form 8938. For FBAR, non-resident aliens are generally not required to file unless they are doing business in the United States. For Form 8938, non-resident aliens are only required to file if they have U.S. source income and are required to file a U.S. tax return. The reporting thresholds for non-resident aliens who do need to file Form 8938 are the same as for U.S. residents. Non-resident clients should carefully review their specific situation with a tax professional to determine their filing obligations, as the rules can be complex and depend on factors such as the type of visa they hold and the nature of their U.S. connections.

How to Report for Those with Signature Authority but No Financial Interest

Individuals who have signature authority over foreign accounts but no financial interest in them face a unique reporting situation. These individuals must still file an FBAR to report the accounts over which they have signature authority. However, Form 8938 generally only requires reporting of foreign financial assets in which you have a financial interest. Signature authority alone typically doesn't trigger a Form 8938 filing requirement.

How to file FBAR and Form 8938 Online

Fbar filing

Preparation: Gather all necessary information about your foreign financial accounts, including account numbers, financial institution names and addresses, and maximum account values during the year.

Access the filing system: Go to the Financial Crimes Enforcement Network's (FinCEN) BSA E-Filing System website (https://bsaefiling.fincen.treas.gov/main.html)

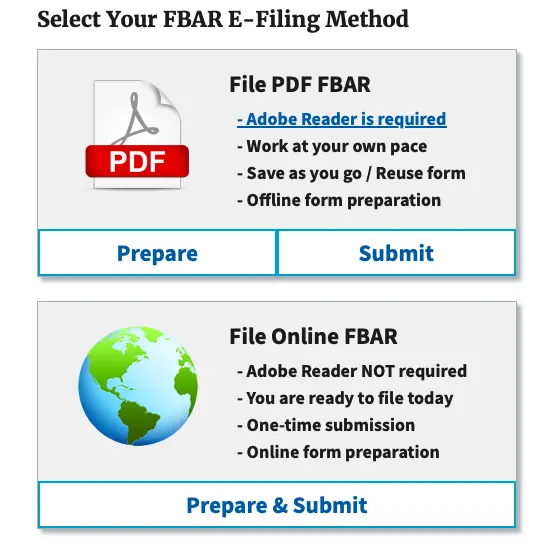

As shown above you To file an FBAR, you have two options: You can either download a PDF form, fill it out, and submit it later, or you can complete and submit the form directly online without needing to download any software. Both methods allow you to report your foreign financial accounts to the IRS.

Registration: If you're a first-time filer, register for a BSA E-Filing account. Returning filers can log in with their existing credentials.

Complete the form: Select "File FinCEN Form 114" and fill out all required fields. The form is divided into several parts, including personal information and details about each foreign account.

Review and submit: Carefully review all entered information for accuracy. Once satisfied, electronically sign and submit the form.

Confirmation: Save or print the confirmation page for your records. The BSA E-Filing System will also send a confirmation email.

Deadline: File by April 15th, with an automatic extension to October 15th if you miss the April deadline.

Form 8938 Filing

Determine if you meet the filing threshold: Check if your foreign financial assets exceed the reporting threshold for your filing status and residence.

Obtain the form: Download Form 8938 from the IRS website (www.irs.gov) or use tax preparation software that includes this form.

Gather information: Collect details about all reportable foreign financial assets, including maximum values during the year and year-end values, income generated, and identifying information for each asset.

Complete the form: Fill out all applicable parts of Form 8938. The form is divided into six parts, covering different types of foreign financial assets.

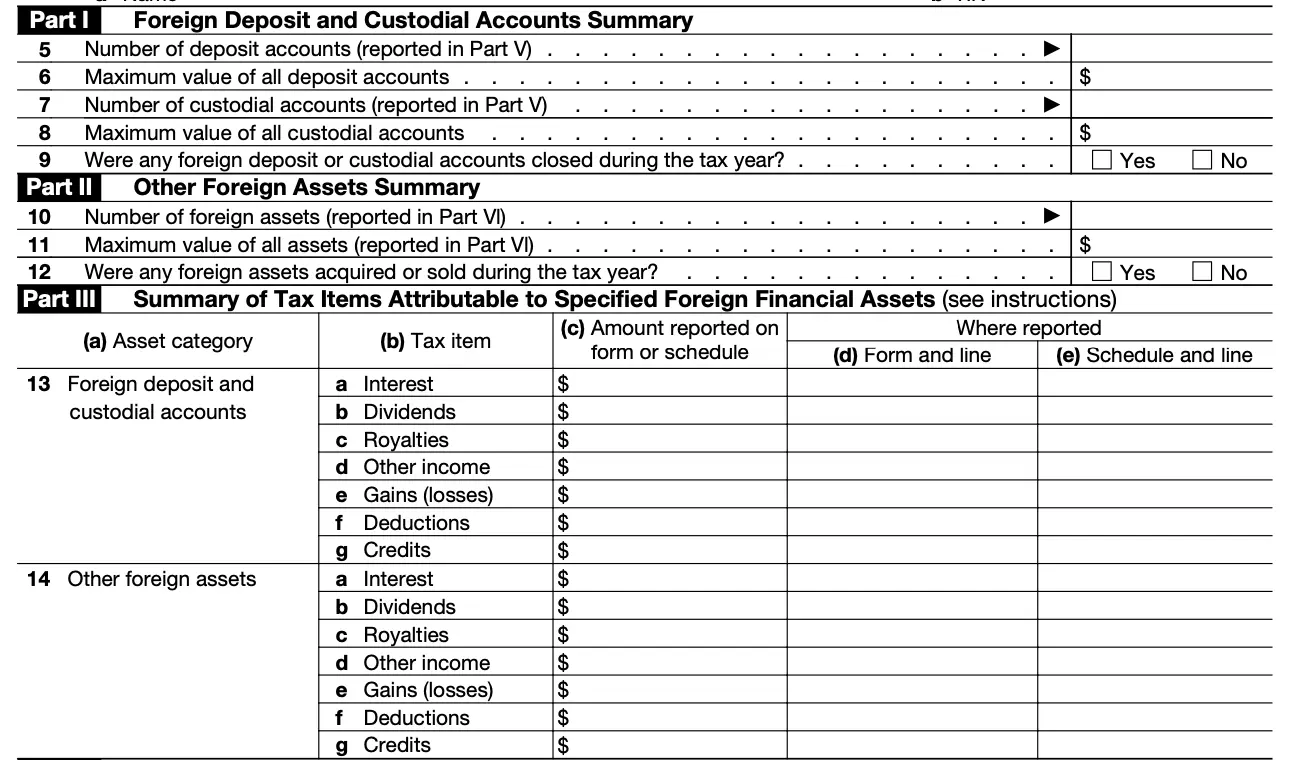

As shown above Part II of Form 8938 summarizes your foreign assets that aren't in deposit or custodial accounts, providing a count, their maximum value, and whether there were any asset transactions during the year. Part III focuses on the tax implications of your foreign financial assets, detailing income, gains, losses, deductions, and credits generated by both deposit/custodial accounts and other foreign assets.

Calculate values: Convert all foreign currency amounts to U.S. dollars using the appropriate exchange rates.

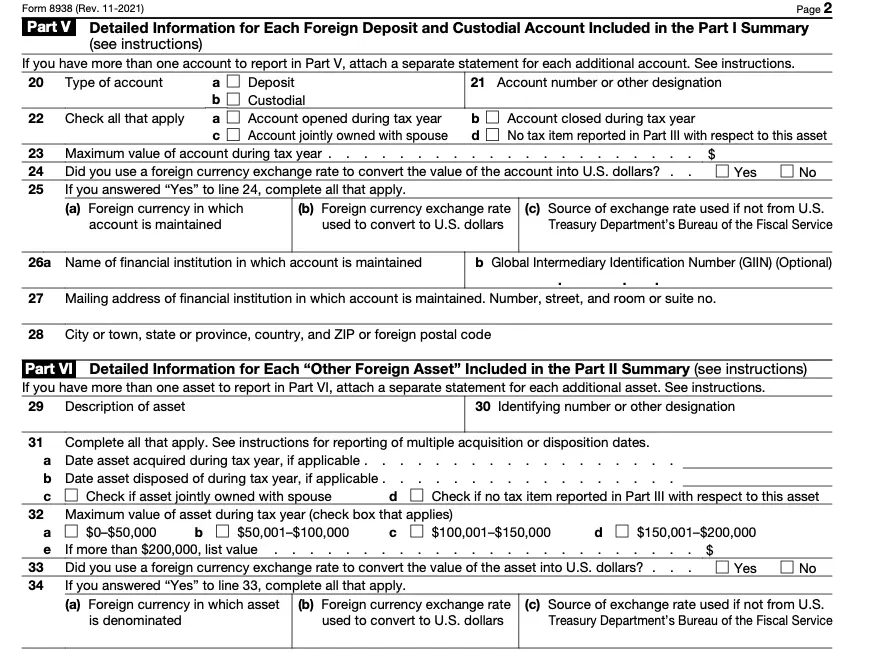

As shown in the image Part V and VI of Form 8938 require detailed information about each foreign financial asset reported in Parts I and II respectively. You'll provide specific details like account numbers, ownership, values, and financial institution information for each asset.

Attach to tax return: Include the completed Form 8938 with your annual federal income tax return (Form 1040).

File your tax return: Submit your complete tax return, including Form 8938, by the regular tax filing deadline (usually April 15th, or October 15th if you file for an extension).

When to Consult a Tax Professional for FBAR and Form 8938?

Given the complexity of international tax reporting and the potential for severe penalties for non-compliance, many individuals with foreign financial assets choose to work with an experienced CPA. This can be particularly advisable if:

- You're new to foreign asset reporting and unsure of your obligations.

- You have a complex financial situation involving multiple foreign accounts or assets.

- You've recently moved to or from the United States and need to understand how this affects your reporting requirements.

- You've discovered past non-compliance and need to address it.

- You're facing an IRS audit or inquiry related to foreign asset reporting.

A tax professional with experience in international tax matters can provide personalized guidance, help ensure compliance with all reporting requirements, and advise on strategies to minimize your tax liability while remaining compliant with U.S. tax laws.