Table of Contents

A business needs to be aware of its liquidity status at different times, as investors and lenders depend upon the projected and current cash flows of businesses to decide whether they should invest in the business. The cash situation of a business must be made readily available for businesses to make accurate business decisions. An apt parameter to be considered to determine the same is the Cash flow forecast, which refers to the cash and cash equivalents that go in and out of business. A positive cash flow signifies increasing liquidity assets and the ability of a business to create value for shareholders. Several methods can be used to analyze the cash flow within a business, including free cash flow, unlevered cash flow, and debt service coverage ratio. Let us analyze the importance of cash flow and how cash flow forecasting can help businesses do better financially.

Why are cash flows essential to a business's health?

Cash flow forecasts are essential to a business as they signify its financial health and ability to meet financial obligations. A positive cash flow signifies a profitable business model, allowing the business to pay its suppliers and workers on time. Businesses survive off of their financial prowess and reputation, and businesses need to maintain both. As stated earlier, a positive cash flow helps maintain economic prowess, leading to a good reputation. You can hire professionals that provide online accounting services to However, these are not its only benefits, as timely payment of dues helps businesses avoid penalties imposed upon parties that make late payments. In addition, cash availability can help you expand without depending on high-interest loans, making things better for the business in the long term. Hiring new employees, upgrading instruments, and sourcing financing opportunities becomes more straightforward when you’ve sorted your cash flow. Therefore, it is safe to say that an accurate idea of the Current and Forecasted cash flow allows businesses to thrive.

How can Cash Flow Forecasting (CFF) assist in making clear business decisions?

Accurate Cash Flow Forecasts allow businesses to make crucial decisions, such as when to invest in new products and how much inventory should be maintained, among other decisions affecting the company's cash situation. It is an integral part of business risk management. It can also point towards potential problems before they occur so businesses can appropriately plan and manage the risks. Businesses need accurate CFF to avoid financial distress or even bankruptcy if the cash outflow trumps the cash inflow for the long term, which is undesirable for any business. The business might find it helpful to have accurate cash flow information as it allows them to make well-informed and crucial decisions. In fact there are online accounting service providers that can use analytical tools to predict cash flow and expected cash flow forecast.

Benefits of CFF

Many benefits are achieved by accurately understanding a company’s cash flow. As the forecast provides insight into the availability of financial resources at hand, the management can make informed decisions regarding project management, capital asset planning, investment planning, working capital management, and financial planning, which are explained as follows:

- The first one is better cash flow management, which allows the management to understand whether a business can meet all the financial obligations it is entitled to.

- Cash flow shortages can be predicted and planned around. An accurate cash flow can help the management decide when it is the right time to apply for a loan without obstructing the flow of operations because of cash shortage.

- Project management requires a good understanding of the cash at hand. Cash flow forecasting allows the management to decide whether the business should hire more resources, or let go of some, to maintain optimal financial health. Businesses decide to facilitate expansion when they have ample cash surplus at hand.

- Capital Asset Planning depends majorly upon cash flow forecasts as the upgradation of available machinery/tools required for business operations, as paying for new assets with cash is preferred over loans.

- Better investment planning is another one of cash flow or accounts forecasting, as a high surplus in cash can be estimated beforehand, making it possible for businesses to plan investments.

- Several scenarios can be simulated and planned with a good understanding of the cash flow. For example, you can predict how a supply bottleneck can affect the cash flow and how a business can handle low customer demands cautiously.

- A good understanding of cash inflow and outflow can help businesses understand what they are spending money on and manage costs in a better way.

- Businesses often need to pay more attention to receivables management, and this is something cash flow forecasting can help with. Businesses can analyze frequent cash flow problems and determine their reasons so they can be dealt with appropriately.

How CFF can be used in CAPEX planning (IRR for returns)

The CFF obtained for a business can help the management plan Capital expenditures in a better way by deciding the CF/CapEX ratio. This ratio determines whether it is a good choice for a business to acquire long-term assets or not. A higher CF/CapEX ratio implies it is more than capable of investing in long-term assets. It provides information regarding the amount of cash a company generates for every dollar invested in capital expenditures, including PPE (Property, Plant, and equipment). A higher ratio generally signifies good financial health of the business and interests investors. A high CF/CapEX ratio also implies that the business would not need to take a loan out for CapEX as they can pay it straight out of their cash reserves, saving the business from paying loan interests.

Things you need to know about DCF (Discounted Cash Flow)

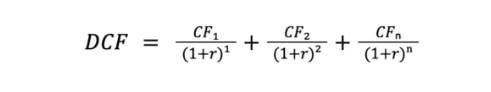

The DCF (Discounted Cash Flow) helps determine whether a business is worth investments based on future cash flows. As it depends upon cash flows in the future, it can be stated that Cash Flow Forecasting needs to be done. The DCF allows companies to decide whether the acquisition or a merger with a company is sensible. DCF Valuation also holds weight in the real estate industry, as well. A single analogy can explain the central concept behind DCF: The value of $10, as of today, is bound to be higher than what it would be a year down the line, thanks to high inflation rates. Therefore, the value of $10 in cash is significantly higher right now than what it would be if you received it a year later. Therefore, to accurately estimate projected cash flow, future cash flows must be discounted to a certain extent. DCF Valuation can be done by following the following formula: r stands for the discount rate, n stands for the number of periods, and CF stands for the cash flows.

Here, CF equals the earnings and dividends a business receives, while the number of periods (n) stands for the number of years the cash flow is expected to sustain, and r stands for the discount rate or the the company’s cost of capital.

Moreover, Discounted Cash Flows also help estimate future cash flows, which in turn allows the management to plan out it's future course of action. Businesses that plan upcoming moves well before their execution manage risks better, therefore allowing a smoother flow of business operations.

Calculating the cash flow can be overwhelming for businesses that do not have a dedicated accounting team to follow through with such extensive procedures. To make a nearly accurate cash flow prediction, a business must have a good idea about the factors that affect the cash flow while staying on top of the inflow and outflow of cash through the bank account registered for the business, as well as other factors that affect the DCF. An accurate DCF estimate allows the management to plan future course of actions while managing risks efficiently. Therefore, it is suggested that businesses keep performing Cash Flow Forecasting at regular intervals. Businesses with dedicated accounting teams find it easier to access these forecasts while smaller, and growing businesses miss out on their benefits. However, the online accounting services provided by NSKT Global allow smaller businesses to carry out these processes without having to worry about human errors or hiring an in-house team of accountants, as most of these processes are automated. The dedicated and well-trained team of accounts professionals housed by NSKT Global specializes in handling intricate and crucial financial parameters. Click here to land on the home page of NSKT Global and learn more about the company's services and how you can leverage these services to benefit your business!