Table of Contents

Income tax is one of the well-known forms of taxation and is paid to the government if you are earning your income in the US. The person must pay income tax on both the federal and state level. Federal taxes include social security and FICA. Each state also has its own form of income tax that employers also withhold from your paycheck. If you earn over a certain amount, $6,750, you must tax filing both federal and state taxes before April 15th of each year.

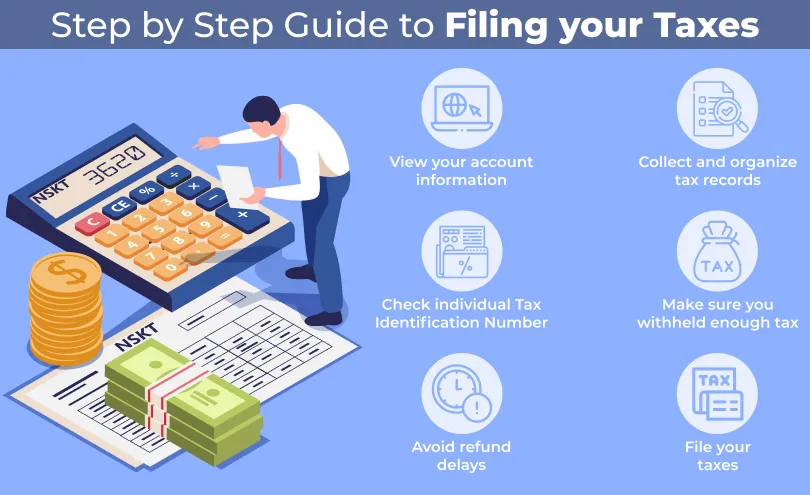

Given below are the steps for Tax Filing in the USA:

- View your account information online- Use online information to securely access the latest information available on the official website of the government IRS.gov about your federal tax account and see information from your most recently filed tax return. If you do not have an account, create your account now. The following information can be viewed

- View the amounts of the Economic Impact Payments you received

- Access the Child Tax Credit Update portal for information about advanced Child Tax Credit payments

- View key data from your most recent tax return and access additional records and transcripts

- View details of your payment plan if you have one

- View 5 years of payment history and any pending or scheduled payments

- Collect and organize tax records- Organized tax records make preparing a complete and accurate tax return easier. It helps you in avoiding errors that can lead to processing delays that slow your refund and may also help you find overlooked deductions or credits. Some of the records that you must have include:

- Forms W-2 from your employer(s)

- Forms 1099 from banks, issuing agencies, and other payers including unemployment compensation, dividends, distributions from a pension, annuity, or retirement plan

- Form 1099-K, 1099-MISC, W-2, or other income statements if you worked in the gig economy

- Form 1099-INT if you were paid interest

- Other income documents and records of virtual currency transactions

- Form 1095-A, Health Insurance Marketplace Statement, to reconcile advance Premium Tax Credits for Marketplace coverage

- Letter 6419, 2021 Total Advance Child Tax Credit Payments to reconcile your advance Child Tax Credit payments

- Letter 6475, Your 2021 Economic Impact Payment, to determine whether you're eligible to claim the Recovery Rebate Credit

- Check your individual Tax Identification Number(ITIN)- A ITIN is needed while filing a U.S. federal tax return. If your ITIN has expired you must get it renewed from the IRS website. There were several ITINs with middle digits 70, 71, 72, 73, 74, 75, 76, 77, 78, 79, 80, 81, 82, 83, 84, 85, 86, 87, or 88 which got expired and they must get a new ITIN. ITINs with middle digits 90, 91, 92, 94, 95, 96, 97, 98, or 99, IF assigned before 2013, have expired. If you have previously submitted an application for renewal then you need not apply for renewal again.

- Make sure you have withheld enough tax It is always kept in mind to keep on adjusting your withholding if you owed taxes or received a large refund last year. Changing your withholding can help you avoid a tax bill or let you keep more money each payday. Life changes – getting married or divorced, welcoming a child, or taking on a second job - may also mean changing withholding. Use the Tax Withholding Estimator to help you determine the right amount of tax to have withheld from your paycheck. You can determine and adjust your withholdings and submit a new Form W-4 to your employer on the official website of the IRS. If you receive a substantial amount of non-wage income like self-employment income, investment income, taxable Social Security benefits and in some instances, pension and annuity income you should make quarterly estimated tax payments, with the last payment for 2021 due on January 18, 2022.

- Get bank to speed tax refunds with direct deposit- The fastest way for you to get your tax filing refund by electronically and choosing direct deposit. A direct deposit gives you access to your refund faster than a paper check. Don't have a bank account? Learn how to open an account at an FDIC-Insured bank or through the National Credit Union Locator Tool. If you are a Veteran, see the Veterans Benefits Banking Program (VBBP) for access to financial services at participating banks. Eight out of 10 taxpayers get their refunds by using direct deposit. The IRS uses the same electronic transfer system to deposit tax refunds that are used by other federal agencies to deposit nearly 98% of all Social Security and Veterans Affairs benefits into millions of accounts. Direct deposit also avoids the possibility that a refund check could be lost or stolen or returned to the IRS as undeliverable. And it saves taxpayer money. It costs more than $1 for every paper refund issued, but only a dime for each direct deposit.

- Reconcile advance child tax credit payments- If you received advance payments when you file your 2021 tax return, you will need to compare the advance Child Tax Credit payments that you received during 2021 with the amount of the Child Tax Credit that you can properly claim on your 2021 tax return. The fastest way for you to get your tax refund which will include your Child Tax Credit is by filing electronically and choosing direct deposit. If you received less than the amount that you're eligible for, you'll claim a credit for the remaining amount of Child Tax Credit on your 2021 tax return. If you received more than the amount that you're eligible for, you may need to repay some or all of that excess payment when you file. In January 2022, the IRS will send you Letter 6419 to provide the total amount of advance Child Tax Credit payments that you received in 2021. You need to keep this and any other IRS letters you received about advance CTC payments you received with your tax records and refer to them when you file.

- Avoid refund delays- There are several factors that affect the refund timing of any individual after the government has received the return request. Although the IRS issues most refunds in less than 21 days, the IRS cautions taxpayers not to rely on receiving a refund by a certain date, especially when making major purchases or paying bills. There are certain returns that require special attention and additional review because of which the return can take longer. For example, the IRS, along with its partners in the tax industry, continue to strengthen security reviews to help protect against identity theft and refund fraud. Additionally, refunds for people claiming the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) can't be issued before mid-February. The law requires the IRS to hold the entire refund − even the portion not associated with EITC or ACTC. There are some returns that are filed electronically or on paper, need manual review delay the processing of refunds because of some possible errors or some missing information, or there is suspected identity theft or fraud. Some of these situations require us to correspond with taxpayers, but some do not. This work does require special handling by an IRS employee so, in these instances, it may take the IRS more than the normal 21 days to issue any related refund. In those cases where IRS is able to correct the return without correspondence, the IRS will send an explanation to the taxpayer.

- File your taxes- For all citizens who are eligible for tax filing in the USA, can use the IRS free file. Since the beginning of January 2022, everyone can file their taxes electronically by visiting the official website of the IRS or with the IRS2Go app. The IRS Free tax filing program offers eligible taxpayers brand-name tax preparation software packages to use at no cost. Some of the free File packages also offer free state tax return preparation. The software does all the work of finding deductions, credits, and exemptions for you. If you're comfortable preparing your own taxes, you can use Free File Fillable Forms, regardless of your income, to tax filing returns either by mail or online.

- In case you are a service member or qualifying veteran you can use the Mil Tax. Members of the armed forces and some veterans may take advantage of MilTax. MIL Tax is a free tax resource offered by the Department of Defense exclusively for the military community. There are no income limits for filing tax through Mil Tax. The process of tax filing on this resource includes tax preparation and electronic filing software, personalized support from tax consultants, and current information about filing taxes. It's designed to address the realities of military life – including deployments, combat and training pay, housing and rentals, and multi-state filings. Eligible taxpayers can use MilTax to electronically file a federal tax return and up to three state returns for free.

- Get your refund status- Once you have filed your taxes, you can check the status of your refund by visiting the official website of the IRS. Simply click on the option Where's My Refund? and your refund status will be shown. But the status of your refund is available on the website within 24 hours after the IRS has accepted your e-filed tax return. In case you have filed a paper return, the status of your return is visible on your website only after four weeks from the date you mailed the documents. You can check your status only once in 24 hours as Where's My Refund? tool updates once every 24 hours, usually overnight. It is advisable to file the tax return electronically and choose Direct Deposit for your tax refund as it is the safest and fastest way to receive your money. Tax returns filed electronically are received within 24 hours, and paper tax returns take weeks. If you file a paper return, you can still choose direct deposit. The FDIC website offers information to help you open an account online.

So, if you have to file your taxes this year make it as quick as possible and have all the documents handy so that you don't face any kind of issue or delay in refunds. If you are not confident about the return filing, get help from consultancy firms and get your work done easily.

NSKT Global is an ideal Business Tax service provider that helps in making an organization exceptional and smart in their domain through their extensive business and compliance knowledge, but most importantly they can work holistically in sync with organizations’ objectives.

Still, have Questions on Filing taxes? Get your FREE TAX consultation and filing done by NSKT Global Experts. Book your consultation now at - Contact Us