Why Choose Us for Expat Tax Services?

Specialized Expertise

Tailored Solutions

Comprehensive Support

Maximized Savings

Our Full Range of Expat Tax Services

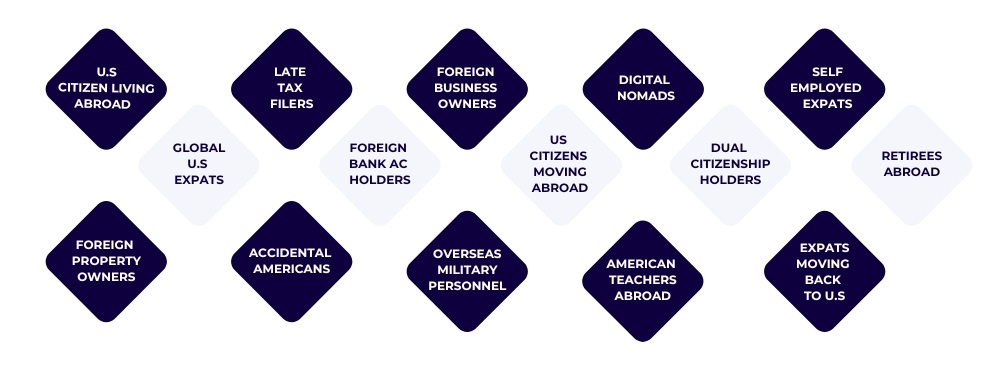

Who Can Benefit from Our Services?

Expats come from all walks of life, and our services are designed to meet the diverse needs of individuals and businesses dealing with international tax matters. Whether you're looking to stay compliant, minimize your tax burden, or simply find clarity in complex situations, our services can help:

Tax Filing Process

Start Your Expat Tax Filing Now

$350

Package Includes:

- Preparation of Form 1040 to report your income accurately

- Claiming the Foreign Tax Credit with Form 1116

- Applying for the Foreign Earned Income Exclusion (FEIE) using Form 2555

- Comprehensive support for Standard Schedules A through E

- Reporting up to three Schedule K-1s for partnership income or losses

- Preparation of Form 8621 (PFIC reporting)

- Filing support for multiple states

(FBAR)

$100

Service Includes:

- Current year FBAR filings

- Back-year FBAR compliance assistance

- Reporting for multiple foreign bank accounts

Choose the option that best fits your needs.

Here's what customers are saying

Nikhil is prompt and professional. I'm a recent graduate on Optional Practical Training (OPT). Nikhil and his team helped me figure out my taxes. They were very thorough in their research and I'm delighted with their service. I recommend him and will definitely continue to use his services.

Nikhil is of the upmost respect when dealing with corporate and personal auditing. He responds quickly and efficiently, and performs quality service. I would recommend him for anything and greatly appreciate his due diligence and compassion towards everything he can assist with....

I have been working with Nikhil for ~a year now, and he has been immensely helpful. I came to him after another CPA firm made multiple errors in my tax submissions. After sorting that out he has further helped me to transition from a W-2 to a K-1, and helped me to discover additional areas of savings that I didn't realize I should have been receiving. He's also always prompt and professional.

I own a health care start-up business and have worked with Nikhil over the past year. Our relationship started with basic accounting and has evolved to tax strategy, accrual accounting, and budget management. Beyond the accounting, we are working with Nikhil to develop comprehensive SOPs for each of my corporation's functional areas while uncovering new efficiencies..