Table of Contents

Taxpayers are wondering if they are entitled to similar tax refunds as in previous years, as the tax refunds for 2021 and 2022 were considerably higher than usual. Steps were taken by the IRS and the government to help tax preparer near me deal with the economic impact of the Covid-19 outbreak. The total amount of tax return was increased substantially for the taxes of FY 2021, owing to factors such as the stimulus check. Let us understand how this aid has helped taxpayers receive more significant tax refunds in 2020 and 2021 and how the tax refunds of 2022 will be affected.

Lower tax refunds in 2023 because of the revoked stimulus payment and over-the-line charitable donation credit.

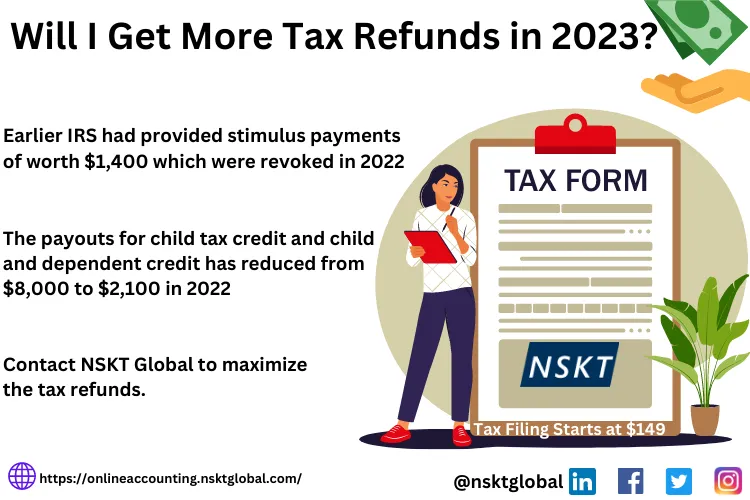

IRS has stated that the tax refunds for 2023 are going to be lower than the previous years because the IRS will not provide taxpayers with Stimulus payments to taxpayers. The stimulus payment has been revoked due to the lack of economic impact payments in 2022. The last round of stimulus payments was received in 2021, worth $1,400. The government provides stimulus checks to taxpayers to boost their spending capacity. In addition, the IRS has also revoked the charitable deductions for the tax year of 2022. The incentives provided by the IRS Refunds to enhance the overall spending capacity of taxpayers through 2020 and 2021 are now being revoked. This means the tax credits and deductions will be lower in 2023, similar to what they were in 2019.

Lower child and dependent care credit, as well as child tax credit

The tax returns for the year 2021 had higher dependent care credits, as the payout for a single-child/dependent went as high as $4,000, while that for two or more dependents was $8,000. These payouts were staggeringly high compared to those received in the previous year, which stood at $1,050 and $2100, respectively. For 2021, the maximum child tax credit was also increased to $3,600 for kids under six and $3,000 until they turn 17, compared to a maximum payout of $2,000 for kids under 16. However, these credits have gone down to their original level for the tax returns to be obtained in 2023. This considerable tax credit trim-off is predicted to bring down the 2023 tax refunds to a huge extent!

Lower EITC

In 2021, the maximum income tax credit for childless workers came to $1500 from $500 in 2019. The minimum age limit was also changed from 25 to 19. The government did this to help taxpayers get through 2021, which was the most impacted by the Covid-19 outbreak. For the tax returns of 2022, this amount went back to its original value, further bringing down the Tax Credits for 2023.

How to get your tax refunds faster

To receive tax refunds faster, you should file taxes online. Taxpayers that choose to file their taxes through mail face delayed tax returns, as the tax documentation, including Form 1040 and supporting documents, take a few weeks to reach the IRS Refunds, which is then predicted to be processed in the next 21 days. Most of the tax filings done by American Taxpayers have been historically recorded to be processed within 21 days. However, it has been noticed that the payment procedure also affects the time taken by the IRS to provide taxpayers with tax returns. The taxpayers choose the mode of payment, and they can receive their tax refunds either by mail or by direct deposit to the taxpayer’s bank.

However, specific errors made while filing for taxes lead to delayed tax returns. Taxpayers should pay particular attention while filling up these details to avoid these errors while filing taxes online. Math errors are one of them. They are simple calculation errors, which, if not done correctly, must be rectified by the IRS. This takes a lot of time, which should be avoided at all times to ensure the reception of tax refunds on time. Therefore, the IRS suggests taxpayers have all their bills and income statements handy before they file taxes online.

Why should you get a good tax preparer to handle your tax affairs?

If taxpayers file taxes online by themselves, there’s a good chance that they might make mistakes or overlook certain transactions that might cost them time and/or money. Making these mistakes might lead to even lower tax refunds in 2023. If you are dealing with the same issue and require assistance with your tax returns, visit the official website of NSKT Global. They employ a trained and qualified team of tax professionals ready to help clients lower their tax bills as much as possible. The tax professionals working with NSKT Global have access to your bank transactions once a taxpayer has connected their bank account with the infrastructure of NSKT Global, which helps them track cash flow. Save yourself a lot of time, and make the tax filing process more pleasant. For more information regarding the services offered by NSKT Global and how you can benefit from their tax services!