Table of Contents

Employee Retention Tax credit (ERC) is a refundable tax credit for employees against certain employment taxes which is equal to 50% of the qualified wages an eligible employer pays to employees after March 12, 2020, and before January 1, 2021. The eligible employers can get immediate access to the credit by reducing employment tax deposits they are otherwise required to make. Also, if the employer's employment tax deposits are not sufficient to cover the credit, the employer may get an advance payment from the IRS. The Employee Retention Tax Credit, also referred to as the ERTC was created by the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which came into effect in March 2020. This law was formulated to encourage businesses to keep employees on their payroll. The Consolidated Appropriations Act, 2021 (CAA), enacted in December 2020, and the American Rescue Plan Act (ARPA), enacted in March 2021, amended and extended the credit and the availability of certain advance payments of the credits through the end of 2021. The ARPA, for instance, allows small employers that received a Paycheck Protection Program (PPP) loan to also claim the ERTC.

Eligibility Criteria

There are no such limits or eligibility criteria for Employee Retention Tax Credit. However different kinds of businesses are treated differently.

For businesses with 100 full-time employees or less- In this case, all the wages of the employee qualify for the credit. Irrespective of whether the business is running or has been subjected to shutdown.

For businesses with more than 100 full-time employees- In this case, the credits are qualified for the employees when an employee was not able to render services due to COVID-19-related circumstances.

- Private-sector businesses and tax-exempt organizations are also eligible for Employee Retention tax credit. But there are certain clauses to it:

- Businesses that faced full or partial shutdown of operations as a result of a government order limiting the operation of the trade or business carried on during the calendar year 2020 and 2021, due to orders from an appropriate governmental authority limiting commerce, travel, or group meetings (for commercial, social, religious, or other purposes) due to COVID-19.

- Gross receipts declined by more than 50 percent during 2020 and 20 percent in the 2021 calendar quarter when compared to the same quarter of 2019.

- A "recovery startup" business that was launched after Feb. 15, 2020, for which the average annual gross receipts do not exceed $1 million, subject to a quarterly ERTC cap of $50,000.

Impact of other credit and relief provisions

- Employee Retention tax credit can be claimed by employers is impacted by the following credit and relief provisions:

- Wages for this credit do not include wages for which the employer received a tax credit for paid sick and family leave under the Families First Coronavirus Response Act.

- Wages counted for this credit can't be counted for the credit for paid family and medical leave under section 45S of the Internal Revenue Code.

- Employees are not counted for this credit if the employer is allowed a Work Opportunity Tax Credit under section 51 of the Internal Revenue Code for the employee.

How to claim the Employee Retention Tax credit?

If an employer wants to claim the new Employee Retention Credit, he/she must fit into the eligibility criteria and will have to report their total qualified wages and the related health insurance costs for each quarter on their quarterly employment tax returns, which will be Form 941 for most employers, beginning with the second quarter. The credit is taken against the employer's share of Social Security tax but the excess is refundable under normal procedures.

By submitting form 7200 Eligible employers can also request an advance of the Employee Retention Credit.

FAQs related to Employee tax retention Credit

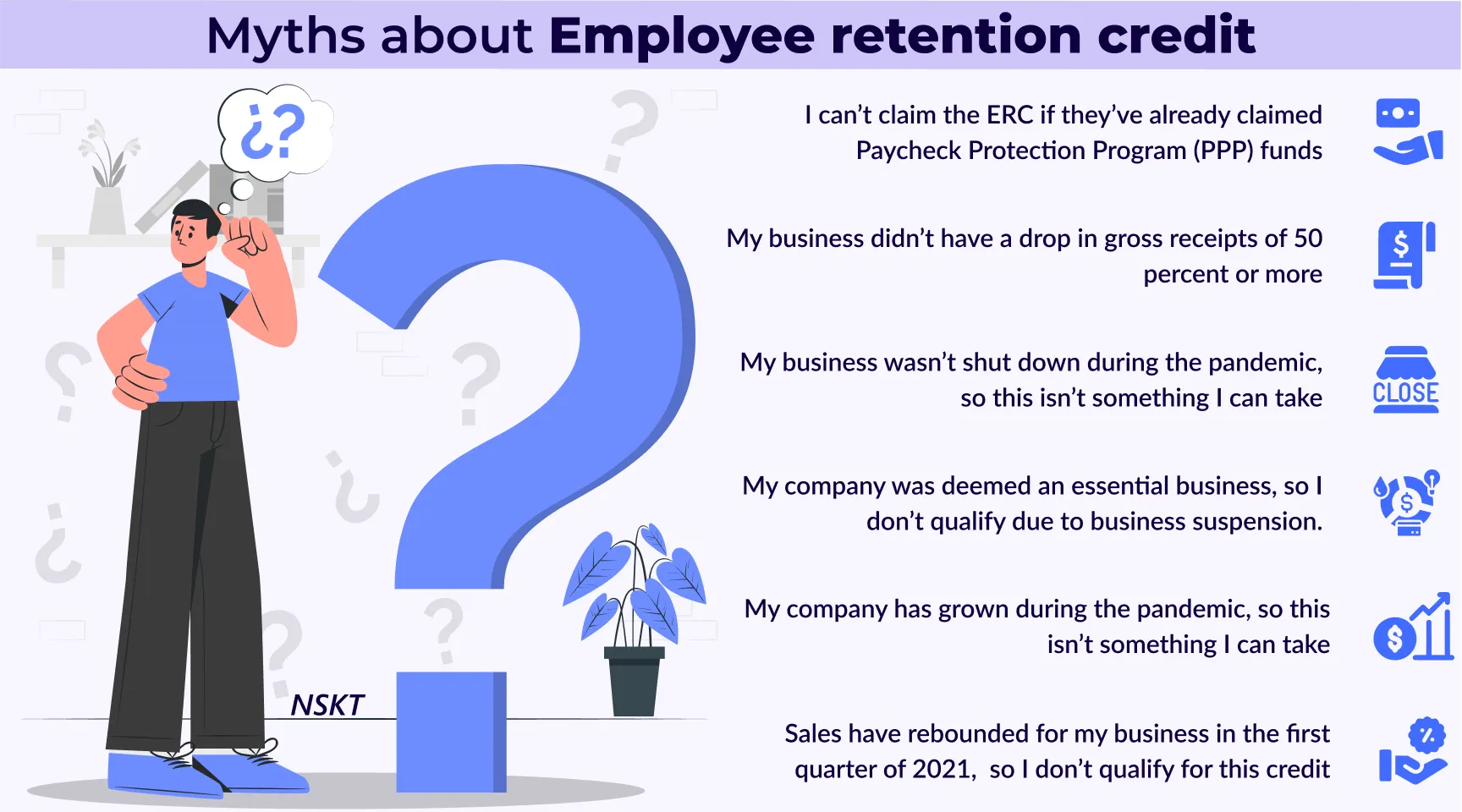

Documents are not properly checked by the IRS (Internal Revenue Services)- It is one of the biggest myths related to Employee Retention Tax credit as the IRS gathers many departments and teams of officers in each department to check all the documents. We cannot expect the IRS to hand over thousands of dollars without going through the documents.

A person cannot claim ERC if they’ve already claimed Paycheck Protection Program (PPP) funds or gotten their PPP loans forgiven- No person can claim both now. These kinds of limitations were removed by Congress in the Consolidated Appropriations Act (CAA) of 2021. But in this case, Paycheck Protection Program (PPP) funds will only account for 2.5 times your monthly payroll expenses and are meant to be spread out over six months. This leaves plenty of uncovered wage expenses for claiming the ERC.

What happens when the business isn’t shut down during the pandemic- The employees of the business can claim Employee retention Tax credit even when there is a partial suspension order for the business by the government (federal, state, or local). Other circumstances include a partial shutdown, business disruption, inability to access equipment, shutdowns of their supply chain or vendors, having limited capacity, reduction in services offered, reduction in hours to accommodate sanitation, shutdown of some locations and not others, and shutdowns of some members of a business are all scenarios that still potentially qualify your client for the ERC.

What happens in cases when the company has seen growth during the pandemic- If the business has seen growth during the pandemic but experienced a full or partial suspension, then also some of the income can qualify for Employee retention tax credit.

Will the business be eligible for an Employee retention tax credit when the Sales have rebounded in the first quarter of 2021- The Citizen Amendment Act (CAA) allows you to look at the past quarter to determine qualification for an Employee retention tax credit. This means an employee can still be eligible for ERC based on the revenue lost in the year 2020. Also, when a business is subject to a full a partial suspension can qualify for employee retention.

What happens when the business is generating losses or doesn't have any tax liability- The employee retention tax credit is refundable. This means that if the taxpayer/business owner has paid any credit above tax liability, then that amount is being refunded to them.

If the employee works for a charity business, will they be eligible for the Employee retention tax credit-Employee retention tax credit is also applicable to a certain amount to charities such as churches, nonprofit hospitals, museums, etc. Charities are considered as one of the best candidates eligible for Employee retention tax credit.

Still, have Questions on Eligibility? Book your consultation and get the Employee Retention Tax Credit Assessment and filing done by NSKT Global Experts. Book your consultation now at - Contact Us