Table of Contents

Raising a kid is one of the hardest things to do and one of the most expensive things. Regular expenses like diapers, baby food, and other necessary items to look after a child prove expensive. This can appear to be troublesome to a few parents who need to be made aware of the tax deduction and tax credit they can avail of if they have a child they are taking care of. These tax credits and deductions can allow parents to lower their tax bills while enhancing their tax returns. Provisions such as child tax credits that the IRS made can prove to be highly beneficial for parents. Parents need to be aware of them to save as much money as possible while filing taxes. Let us look at some ways parents can save money while filing taxes for 2022.

- Exemption on dependents:

Before 2018, parents were eligible for dependent exemptions, which work similarly to deductions. However, after 2018, the dependent exemption was replaced by dependent credits. The adjusted child tax credit is an example of dependent credit, and the new W-4 form allows you to report additional withholding allowances. The dependent credits and extra deductions multiply as the number of dependent children increases for parents, allowing them to lower their tax bills and retain more of their paycheck as an increase in the number of children lowers the taxes withheld on paychecks by the IRS. Examples of the people you can count as dependent include, but are not limited to your children, stepchildren, brothers, sisters, and parents.

- Child tax credit:

The child tax credit often constitutes the most significant part of the tax savings for taxpayers with children, decreasing your tax bills dollar-by-dollar. If you qualified for the child tax credits, you were entitled to a tax credit of $2,000 per child before 2021. If your child is below 17 years of age, be it your biological child or adopted one, is a resident of the US, and has been living with you for more than half a year, you qualify for the child tax credit. The maximum child credit for children under six years of age has been set at $3,600.

- Child, as well as dependent care credit:

You are entitled to this tax credit if you have a child aged below 13 years and have had childcare expenses while working, or if you were looking for a job. A requisite for parents to receive this credit is that you and your spouse need to have some income during the year you are filing for this claim. An income limit governs the child and dependent credits to parents are entitled to it. The American Rescue Plan Act was enacted on 11th March 2021, implying that one could obtain a dependent care credit of up to $4,000 for a single dependent, and $8,000 for two or more dependents. However, it must be kept in mind that if your adjusted gross income turns out to be more than $438,000 you are not eligible for this credit.

- EITC (Earned Income Tax Credit):

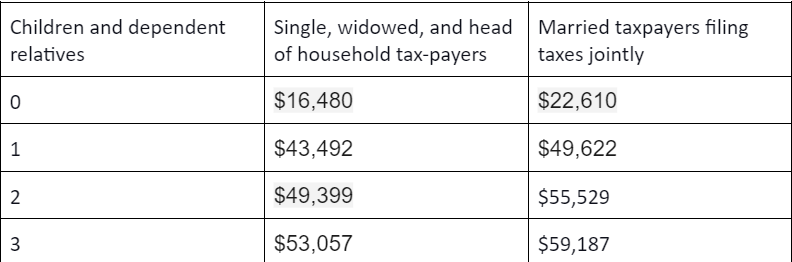

The IRS introduced this credit to assist parents with low wages, which vary based on the number of children they have and their income throughout the year. EITC can bring your tax bill to zero or even provide you with a tax refund in case your tax obligation is lowered to zero. For example, if you have a tax liability of $1,000 and you have a credit of $2,000, you are entitled to a $1,000 refund. If you are filing your taxes as a single, widowed person or as the head of household, then the amount you can claim differs from the amount that you can claim, as a married taxpayer filing taxes jointly. Let us learn about these Tax Credits through a table:

- Adoption-related tax credits:

The costs of adopting a child can be curbed with the help of adoption tax credits, as it allows you to claim a specific tax credit for every child you adopt. The expenses that qualify to be considered for the adoption tax credit include the expenses related to court and attorneys and related meal and travel expenses. If the child being adopted has special needs, you can claim the maximum adoption tax credit allowed by the IRS. You can claim $14,890 as an adoption tax credit if your adjusted AGI is less than $223,410. If your modified AGI lies between $223,410 and $263,410, you will receive a lower adoption tax credit. However, if a taxpayer has an AGI that lies above the $263,410 limit, they will not be eligible to claim Adoption-related tax credits.

- Tax credits for higher education:

There are two credits that parents can claim, depending on their child's age, including the AOTC (American Opportunity Tax Credit) and the LLC (Lifelong Learning Credit). The AOTC is valid for kids up to 4 years of age, while LLC lacks an age barrier. LLC allows you to claim higher education tax credits for as long as your child pursues higher education. You can only claim the tuition fees, enrollment fees, and cost of school materials through these tax credits. There is a specific income limit that users need to match to avail of such tax credits. For the LLC, you can claim 20% of the first %10,000 that you have spent on books, tuition, and fees. The limit for LLC stands at $2,000. However, the AOTC allows you to claim a maximum of $2,500, if your modified AGI lies below $80,000, filing as a single taxpayer, and $160,000 if you are married, filing taxes jointly.

- Deduction related to student loan interests:

Student loan interest tax credit allows you to deduct the payments you make towards student loan interests from your taxable income. You can deduct your taxable income by $2,500 at most and lower your tax bills for the year. Such expenses are referred to, as over-the-top expenses, and can be listed even if you are opting for standard deductions while filing your taxes.

- Health insurance deduction for self-employed parents:

It is required for self-employed parents to pay for their health insurance and their families. However, one can deduct health insurance premiums for children under 27. The health insurance benefits that allow you to claim this deduction include dental, long-term care, and medical premiums. You will not qualify for this deduction if your spouse is entitled to employer-sponsored insurance covering your children.

Parents in the US can avail of various benefits if they have dependents who qualify for deductions and credits listed under their name on the tax documents. You might also end up getting a tax refund if your tax obligations become zero. Some deductions and credits include dependent exemption, child tax credit, child care credit, student loan interest, and health insurance-related deductions. Parents need to be aware of the qualifying criteria of each of these tax deductions and credits for them to be able to lower their tax bills while enhancing their tax returns. However, keeping track of all the possible tax deductions can get hectic, and individuals might leave money on the table. NSKT Global can help with this, as trained, experienced professionals are adept at designing tax strategies for optimal tax filing. Head over to the official website of NSKT Global to learn how!