Table of Contents

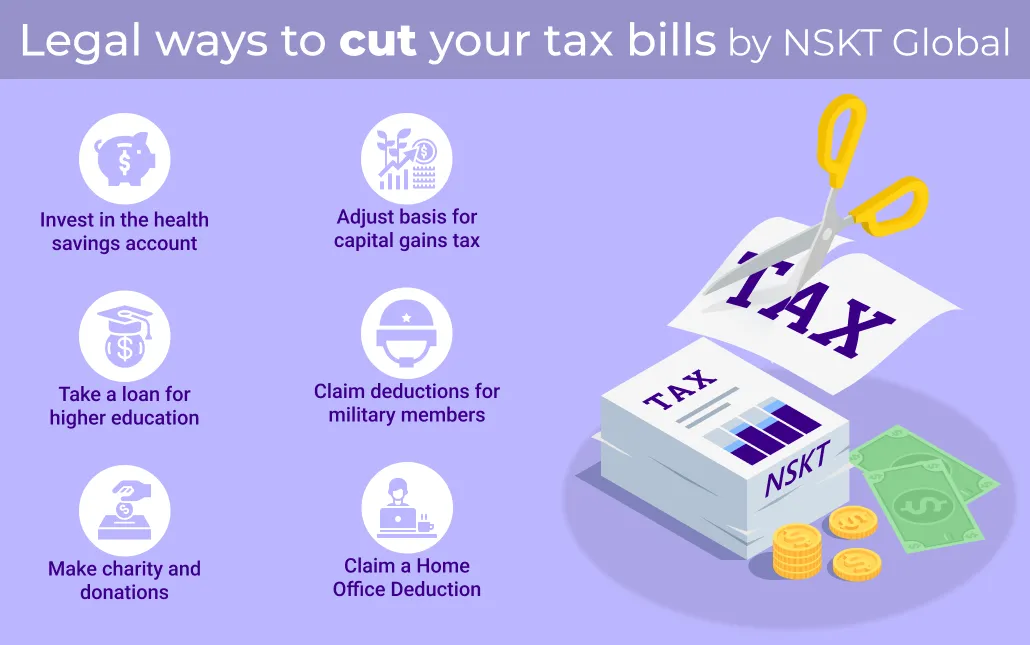

Taxes are an inevitable part of our lives and we all need some relief from them. There are many people who try to save money by not paying taxes which is illegal. But saving taxes through some best practices is legal and can be practiced by people in order to save some part of their taxes. But one should also remember not paying taxes is not an option rather just save some amount with legal practices. Some of the legal ways of saving taxes are credits, deductions, and advanced investment strategies. There are some legal ways of saving taxes that are only applicable for small businesses and self-employed people but there are several others that can be used by all others. Some of the ways for saving taxes include:

- Invest in the health savings account- If you think the investment you are making in medical plans is usually higher and you need medical assistance at a higher amount, then contributing to a health savings account is a great way of saving taxable income and reducing paying taxes. The money that is being spent on medical expenses is never taxed by the government. Contributions made to these accounts are instantly made tax-free. The money saved in these accounts can be withdrawn tax-free for qualified medical expenses. The balance left in the medical account at the end of the year can roll over indefinitely to the next year, similar to the assets in a retirement account.

- Save in retirement account- Saving money in retirement accounts is one of the best and easiest ways of saving taxes. It is the best legal strategy that can be used by everyone for saving taxes. Contribution of the amount to traditional 401(k) and IRA accounts is usually deducted from the taxable income and thus reduces the amount of federal tax owed by you. This income is tax-free until retirement. There are also Roth accounts which are funded with after-tax dollars. But the money in the Roth account does not get a tax deduction, but the money in the account grows tax-free and can be withdrawn tax-free post-retirement. While the contributions to the retirement account can be made till the end of the year, tax-deductible contributions can be made to traditional IRAs up until the deadline of the tax-filing date.

- Take a loan for higher education- The government offers valuable tax credits to offset the cost of higher education. The American opportunity tax credit can be claimed for the first four years of college and provides a maximum credit of $2,500 per student per year. Since the amount that you got from the government is in form of credit, there is a reduction in the taxable income that you owe the government. If the tax credit that you got from the government exceeds the amount of taxes you owe, up to $1,000 may be refundable to you. The learning credit that you get from the government is great for adults in boosting their education and training. This credit that you get is worth up to $2,000 per year which helps you in paying your college and educational expenses to improve your skills and knowledge.

- Make charity and donations- Charitable contributions made with payroll deductions, cheques, cash, and donations of goods and clothing are all deductible. The things that you donate must be itemized to claim a deduction. The 2017 tax reform nearly doubled the standard deduction due to which people stopped itemizing donations. But the Coronavirus Aid Relief, and Economic Security Act, or CARERS Act, allowed taxpayers to deduct cash donations of up to $300 by itemizing. This cash donation deduction is again available for the 2021 tax year. This year's tax filing has a change for donations made, the married couple who make donations in cash can jointly deduct a total of $600.

- Adjust basis for capital gains tax- While calculating the cost basis after selling a financial asset, you must make sure to add in all of the reinvested dividends. Doing this increases the cost basis and reduces your capital gain when you sell the investment. For example, when you sell your house, you may end up paying capital gains tax as well, particularly when the value of the property has risen significantly. An amount of $250,000 is exempted from Single taxpayers of their home's appreciation from the capital gains tax, while married couples get a $500,000 exemption. The Internal Revenue Services only allows the exemption to be claimed once every two years. However, taxes can be reduced if any kind of home improvements or renovations have been made by the owner.

- Avoid capital gains tax by donating stock- Another way of saving taxes is by making charitable gifts using stocks. This method can be also used for avoiding capital gains. The money that you move into a donor-advised fund is not only exempted from capital gains tax but can also be deducted by those who itemize donations. Donor-advised funds can be started with a minimum amount of $5,000, depending on the firm you use.

- Invest in qualified opportunity funds- This category for saving funds is not accessible for everyone but these qualified funds can save investors a significant amount of tax money. Qualified opportunity zones were created by the Tax Cuts and Jobs Act of 2017 as a way to revitalize designated areas. Investors who are eligible can move gains that are acquired by the sale of stocks or from any other sources into the qualified opportunity funds which invest in projects in these areas. This method can be used for reducing the capital gains tax on that money for up to 10 years. And thus the subsequent gains on the investment may be tax-free for those 10 years.

- Check for flexible spending accounts at work- If you dont have a high deductible medical health expense in a medical account, still medical expenses can be paid with tax-free dollars if your employer offers flexible spending accounts. Flexible spending accounts use payroll deductions to fund an account. The money saved in the flexible spending accounts can be used to pay for expenses such as insurance copays, dental charges, medical expenses, medications, etc. So, in simple terms, why use real dollars when you can use pretax dollars for all the extra expenses. Several companies offer flexible spending accounts to employees for both health care and dependent care. In both these cases, there are certain limits on the deposits made in the account, and money deposited may be forfeited if not used by the end of the year.

- Claim deductions for military members- For people, those who work in military services such as national guards can claim for an additional deduction of the taxable amount. If you are in military services and travel for more than 100 miles from home and need to be away overnight, then the amount you earn such as reimbursement, travel expenses, meals expenses, lodging expenses, etc does not come under taxable income. If you are an active member of duty services, you can deduct any costs associated with moving for a permanent change of station from your taxable income.

- Deduct taxes up to 50% from the self-employment taxes- Federal Insurance contributions Act tax of 15.3% is being assessed by the government on all earnings of an individual to pay for the Social Security and Medicare programs. Most employers working with an organization or being employed at a government organization split this amount with their workers. But the people who are self-employed individuals pay this entire amount individually. To compensate for the extra expense, the government will let you deduct 50% of the amount paid from your income taxes. You don't even need to itemize to claim this tax deduction.

- Wave off business travel expenses- It is advisable to combine business trips with vacations and thus you could reduce vacation costs by deducting the percent of the expenses spent for business purposes. This could include airfare and part of your hotel bill, proportionate to the time spent on business activities.

- Deduct Private Mortgage Insurance Premiums- The chances that you are paying private mortgage insurance are high if you have less than 20% equity in your home. This coverage is required by lenders as a way to protect them in the event that you stop making payments. Until 2017, taxpayers could deduct the cost of private mortgage insurance on their itemized deductions. While the Tax Cuts and Jobs Act eliminated the deduction, it has been reinstated by Congress each year and will again be available for the tax year 2021 filings.

- Itemize state sales tax- State income tax or state sales tax can be included for tax deductions by taxpayers on their Schedule A form. If you are living in a state without an income tax, the state sales tax break is a great option. People should remember to add on the sales tax from any major purchases done such as car purchases, home purchases, or boat purchases to easily claim their sales tax deductions. Taxpayers can use a table provided by the IRS to easily claim their sales tax deduction. The federal tax deduction for state and local taxes is capped at $10,000 from all sources.

- Look for an Earned Income Tax Credit- Even if you aren't required to pay federal income taxes, you could get a refund from the government. The earned income tax credit is a refundable tax credit of up to $6,728 for the tax year 2021. The EITC is calculated with a formula that takes into consideration income and family size. The income limits for the credit range from $21,430 for single taxpayers with no children to $57,414 for married couples filing jointly who have three or more children.

- Rent out your home for business meetings- Augusta rule states that homeowners can rent out their space in the home for 14 days and the income generated is not required to report to the IRS. But the home cannot be the primary place of business for the owner. It should strictly be the only residential place of the owner. This is the best way to reduce taxes for business owners who does not have a home office of their own. House owners can rent out a room in their house for a business meeting, deduct the cost from their business taxes and then not have to claim the rental fees on their personal tax return.

- Claim a Home Office Deduction- Home office deductions are for those who have a side business or work for themselves. To qualify for the tax deductions, the space must be used regularly and exclusively for business purposes. This way one can easily claim for home office deductions.

So, if you think you fit in any of these categories just save your taxes by applying the legal of saving taxes. We work hard to earn money thus it becomes our responsibility to save money wherever possible and we should look for legal opportunities to save money and reduce our taxes.

Still have Questions on cutting taxes? Book your first free TAX consultation and filing done by NSKT Global Experts. Book your consultation now at - Contact Us