Table of Contents

What is an R&D Tax credit?

The government of the United States has made several attempts to provide incentives for businesses to indulge in research activities. Higher expenditure on R&D and innovation of products and services help businesses generate higher revenues. Higher generation of revenues compounds into better economic growth. Therefore, Businesses can deduct research expenditures or claim a tax credit for the same. However, taxpayers cannot deduct research expenditures from their taxable income and claim the credit at the same time irrespective of whether they file their business tax credits online, or offline. It is therefore suggested that the taxpayer figures out both, and chooses the more beneficial one.

What is qualified research activity?

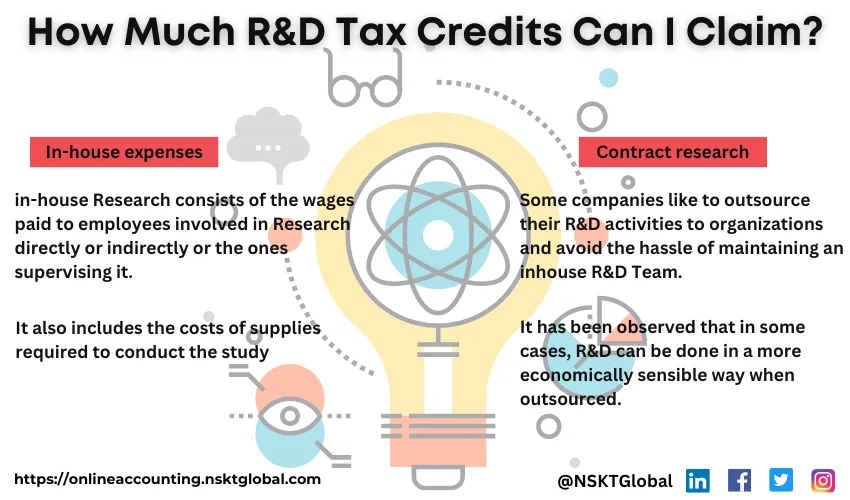

The money spent on Research can only be used to claim a tax credit when several qualifications are met, at the time the taxpayer The research expenses that qualify a taxpayer to claim the R&D Tax Credit include in-house and contract research expenses. Some of these expenses are listed below:

- In-house expenses:

- In general, in-house Research consists of the wages paid to employees involved in Research directly or indirectly or the ones supervising it.

- It also includes the costs of supplies required to conduct the study.

- These expenses include the amount paid to service providers hired to facilitate some unavoidable part of the Research.

- Contract research: Some companies like to outsource their R&D activities to other organizations and avoid the hassle of maintaining an inhouse R&D Team. It has been observed that in some cases, R&D can be done in a more economically sensible way when outsourced, leading to higher business tax credits

- Therefore, the expenses incurred by a company to facilitate contract research also qualify to be listed for the R&D Tax Credit while you file taxes online.

What qualifies for the R&D tax credit?

Several Research activities qualify for the R&D Tax Credit, including developing processes, patents, prototypes, techniques, and formulas, among many others.

- The amount spent on improving products that already exist in the market, or redesigning them, can be used to offset your tax bills by claiming the R&D Tax Credit. Companies often hire engineers, scientists, and designers to help with research, as they have prior experience regarding the research topic.

- The time, effort, and money spent on the innovation of existing and new products cost a lot of money, which comes under the list of activities that can be used to receive the R&D Tax Credit.

- Developing intellectual property and the amounts paid to employees or other parties in favor of the services offered to facilitate the Research are also included in the abovementioned list.

- Businesses also have the option to claim up to $250,000 every tax year as the R&D Tax Credit on the payroll taxes they are supposed to pay, when they file taxes online. The IRS suggests a four-part test to determine whether an activity qualifies for the R&D Tax Credit, consisting of the following parts:

- Permitted purpose: The Research must be carried out to enhance the quality, performance, function, or reliability of a product, formula, process, software, or invention.

- Technological: The business component that is being developed must be based on engineering, biological or computer sciences, or other branches of hard science.

- The presence of uncertainty: If the organization has faced technological uncertainty while designing a business component, or developing it, to pass the test, it qualifies for the credit. Therefore you need to consider the presence of uncertainty if you file taxes online.

- Experimentation process: The company must have evaluated several design alternatives and tried a trial-and-error method to avoid uncertainties, to enhance their R&D, and business tax credits.

How has the R&D tax credit evolved?

The R&D Tax Credit was established in 1981, and it has been subjected to several changes since its inception, and the changes that have impacted this tax credit the most include the ones made during the recent decades. In 2003, the Discovery rule was banished, and research activities were no longer required to give birth to something new to the world. It allowed companies to introduce new products to the taxpayers and claim R&D Tax Credits. In 2015, the Protecting Americans from Tax Hikes (PATH) Act made it possible for small and mid-sized businesses to claim the R&D Tax Credit and made it permanent. Startups could now benefit from the tax credit being discussed. There are several new information requirements related to Research, and it is required by the taxpayer to identify every business component that can be used to claim the credit, as well as all the activities conducted for the Research. The company must also provide the name and details of individuals involved in the Research in any way. The taxpayer is supposed to report all the expenditures on salaries, supplies, rentals, and contract research expenses on Form 6765.

How to compute the credit?

There are two ways of computing the R&D Tax Credit, and a business should try out both to find out which one provides more benefit. The first is the "regular credit" in Section A of IRS Form 6765, and the second is "alternative simplified credit" in section B. The rules stay the same, regardless of whether you file taxes online, or offline.

Regular credit:

Suppose your current year Qualified Research expenses amount to $150,000, and you qualify for the 3% fixed-base percentage, and your 4-year average annual gross amounts to $200,000 (Line 11). This amount is multiplied by the percentage ($200,000*0.03), and the base amount is determined, which comes up to be $6,000. The Excess QRE (Qualified Research Expenses) is then determined by subtracting the base amount from the total QRE. This leaves us with ($200,000-$6,000) = $194,000. 50% of the original QRE comes up to be $100,000. This is less than the remaining QREs ($194,000). The smaller out of 50% of the original QRE and the remaining QRE, after subtracting the base amount, is chosen, and the tax credit is calculated by multiplying it by 20%, which leaves us with $20,000, which is the R&D Tax Credit.

ASC Formula

The QRE of the most recent four years is taken, and the QRE of 3 previous years is averaged. Suppose the QREs for four subsequent years are $50,000, $60,000, $70,000, and $80,000. The average of the three previous years' QREs equals $60,000. This is halved, which leaves us with $30,000. This is the base amount. The base amount is then subtracted from the current year QRE, which leaves us with (80,000-$30,000) = $50,000. This amount is multiplied by 14% to determine the available tax credit of $7,000.

What is the startup provision under the R&D tax credit?

The startup provision allows unprofitable startups to use the R&D Tax Credits they are entitled to lower their payroll tax bills by up to $250,000 every year they are unprofitable. The R&D Tax credits available to a nonprofitable startup can help offset the FICA payroll taxes for up to five years. This implies that an unprofitable startup can avoid up to $1.25 million in payroll taxes.

How can NSKT Global help with claiming of R&D tax credit

A business needs to track all expenses to understand what goes in and out of business accurately. This helps businesses to enhance their business tax credits. To do so, you must source help from tax professionals specializing in this field. Doing it alone is hectic and often leaves room for error. However, the tax professionals at NSKT Global keep your books updated and monitor every in and out of your business, allowing you to consider every expense incurred by the business if R&D is done. Our tax professionals help you figure out, and file taxes online. Considering every qualifiable research expense, the tax credit can be increased for businesses, allowing the taxpayer to save more! Head over to the home page of NSKT Global to understand how the services provided by the NSKT Global team can benefit your business!