Table of Contents

How Does Accounting and Bookkeeping Outsourcing Increase Efficiency in Your Business?

In today's dynamic business environment, organizations are constantly seeking ways to optimize operations and reduce costs while maintaining high-quality financial management. Accounting and bookkeeping outsourcing has emerged as a strategic solution that enables businesses to achieve these objectives while focusing on their core competencies. As companies face increasing complexity in financial regulations and reporting requirements, the decision to outsource these crucial functions can significantly impact operational efficiency and business growth. Understanding how outsourcing can transform your accounting operations is essential for making informed decisions about your business's financial management strategy.

What is Accounting and Bookkeeping Outsourcing?

Accounting and bookkeeping outsourcing involves partnering with external professionals or firms to handle various financial management tasks that would traditionally be performed in-house. This modern approach to financial management has evolved significantly with technological advancements, allowing for seamless integration between businesses and their outsourcing partners.

Key components typically included in outsourcing services:

- Daily Bookkeeping: Management of accounts payable and receivable, bank reconciliations, and transaction recording. This fundamental service ensures accurate daily financial records and timely processing of all transactions, forming the foundation for higher-level financial analysis.

- Financial Reporting: Preparation of monthly, quarterly, and annual financial statements, including balance sheets, income statements, and cash flow reports. These comprehensive reports provide crucial insights into business performance and financial health.

- Payroll Processing: Complete management of employee payments, tax withholdings, benefits calculations, and related compliance requirements. This complex area requires constant attention to changing regulations and precise calculation of various components.

- Tax Compliance: Handling tax preparation, filing, and planning to ensure adherence to all relevant regulations while maximizing legitimate tax benefits. This includes staying current with tax law changes and identifying potential deductions or credits.

Key Ways Outsourcing Accounting and Bookkeeping Increases Efficiency

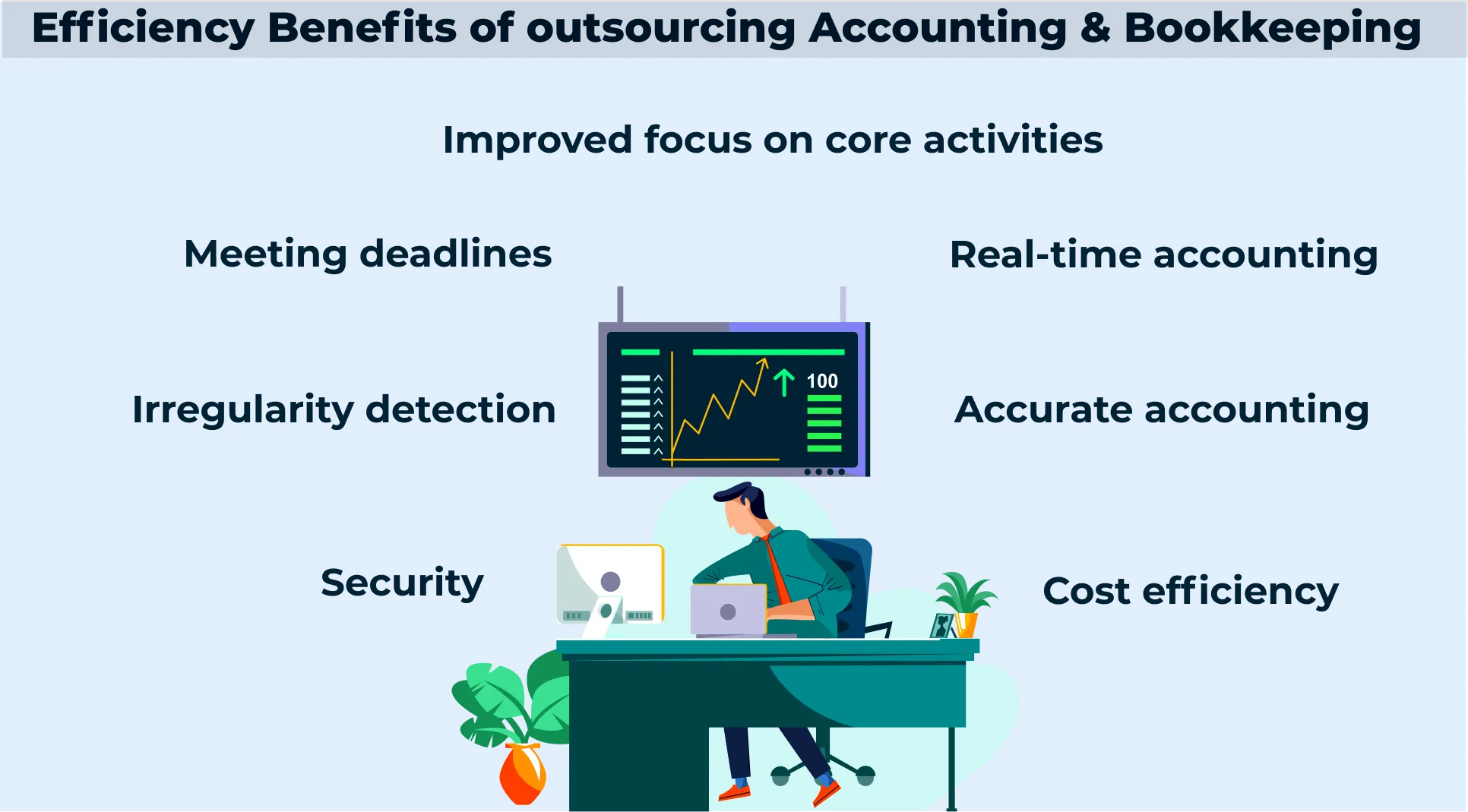

The decision to outsource accounting and bookkeeping functions can transform your business operations in multiple ways. Modern outsourcing solutions leverage technology, expertise, and economies of scale to deliver efficiencies that would be difficult to achieve in-house. These improvements manifest across various aspects of your business, from direct cost savings to enhanced strategic capabilities. Understanding these benefits can help you evaluate the potential impact of outsourcing on your organization and make informed decisions about your financial management strategy.

Cost Optimization

Outsourcing transforms fixed costs into variable expenses, providing significant financial flexibility and efficiency. This shift allows businesses to scale their financial operations up or down based on actual needs rather than maintaining a constant overhead.

- Reduced Labor Costs: Eliminate expenses related to full-time employees, including salaries, benefits, training, and workspace. This can result in savings of 40-50% compared to maintaining an in-house team.

- Technology Cost Savings: Access to advanced accounting software and tools without direct investment in expensive licenses and maintenance. Outsourcing partners typically provide access to enterprise-level solutions as part of their service.

- Infrastructure Savings: Reduce or eliminate the need for dedicated office space, equipment, and related overhead costs for accounting staff.

Enhanced Accuracy and Expertise

Professional outsourcing firms bring specialized expertise and robust quality control processes to your financial operations.

- Access to Specialists: Gain the benefit of experienced professionals with diverse industry knowledge and specialized skills, ensuring high-quality financial management across all areas.

- Reduced Error Rates: Benefit from established quality control procedures and multiple levels of review that significantly minimize errors in financial records and reports.

- Regulatory Compliance: Stay current with changing regulations and requirements through experts who continuously monitor and adapt to regulatory changes.

Improved Focus on Core Business

Outsourcing allows business owners and management to redirect their attention to strategic initiatives and growth opportunities.

- Time Recovery: Free up management time previously spent on financial oversight and routine accounting tasks for strategic planning and business development.

- Resource Optimization: Reallocate internal resources to revenue-generating activities and core business operations.

- Strategic Planning: Gain better insights for decision-making through professional financial analysis and reporting.

Related Read: Top 10 Benefits of Bookkeeping Advantages

When Should You Consider Outsourcing?

Recognizing the right time to transition to outsourced accounting services is crucial for maximizing the benefits while minimizing disruption to your business operations. While outsourcing can benefit companies at any stage, certain situations and challenges make it particularly advantageous. Understanding these trigger points can help you make a timely decision about implementing an outsourcing strategy. Most businesses find that a combination of factors, rather than a single issue, drives their decision to explore outsourcing options. The decision to outsource accounting and bookkeeping functions often coincides with specific business circumstances or challenges such as:

Growth Phase Indicators

- Rapid Business Expansion: When your company is experiencing significant growth, and internal resources are stretched thin trying to manage increased transaction volumes and complexity.

- Geographic Expansion: As you enter new markets or territories, requiring additional expertise in different regulatory environments and accounting standards.

- Increasing Complexity: When financial operations become more sophisticated, requiring specialized knowledge or additional resources beyond current capabilities.

Operational Challenges

- Resource Constraints: When maintaining a full-time accounting staff becomes cost-prohibitive or when finding qualified local talent proves difficult.

- Technology Limitations: If your current accounting systems are outdated or inadequate for your growing needs, and upgrading internally would require significant investment.

- Compliance Concerns: When keeping up with changing regulations and reporting requirements becomes increasingly challenging for your internal team.

How to Choose the Right Outsourcing Partner for Your Business

Selecting an outsourcing partner for your accounting and bookkeeping needs is a critical decision that can significantly impact your business's financial health and operational efficiency. Unlike a simple vendor relationship, this partnership requires careful consideration as it involves entrusting sensitive financial information and crucial business processes to an external team. The right partner should not only provide technical expertise but also align with your business values, understand your industry-specific challenges, and demonstrate a commitment to your long-term success. By understanding key selection criteria and conducting thorough due diligence, you can identify a partner who will contribute meaningfully to your business growth while minimizing potential risks. Consider these essential factors:

Expertise and Experience

- Industry Knowledge: Look for partners with specific experience in your industry sector who understand unique challenges and requirements.

- Technology Proficiency: Ensure they utilize modern accounting software and tools that can integrate with your existing systems.

- Track Record: Verify their history of successful partnerships and client satisfaction through references and case studies.

Service Capabilities

- Scope of Services: Confirm they can handle all required functions and scale services as your needs evolve.

- Communication Protocols: Establish clear channels for regular updates, problem resolution, and strategic discussions.

- Quality Control: Understand their process for maintaining accuracy and ensuring compliance with relevant standards.

Security and Compliance

- Data Protection: Verify their security protocols for handling sensitive financial information and maintaining confidentiality.

- Regulatory Compliance: Ensure they maintain current certifications and comply with relevant industry standards.

- Disaster Recovery: Confirm they have robust backup systems and business continuity plans in place.

How NSKT Global Can Help

NSKT Global offers comprehensive accounting and bookkeeping outsourcing solutions designed to enhance your business efficiency and financial management. Our team of certified professionals brings extensive experience across various industries, ensuring accurate, timely, and compliant financial operations. We leverage advanced technology and standardized processes to deliver consistent, high-quality services while maintaining cost-effectiveness. Our customized solutions adapt to your specific needs, whether you're a growing startup or an established business looking to optimize operations. With NSKT Global as your outsourcing partner, you gain access to expertise, advanced tools, and proven methodologies that drive efficiency and support your business growth objectives.

Contact us today to explore how our outsourcing solutions can transform your financial operations and contribute to your business success.